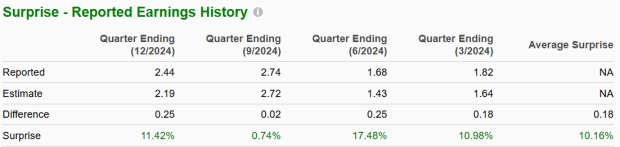

Constellation Energy Corporation (CEG – Free Report) reported fourth-quarter 2024 earnings of $2.44 per share, which surpassed the Zacks Consensus Estimate of $2.19 by 11.4%. In the year-ago quarter, the company reported a loss of 11 cents. The fourth-quarter earnings reflect favorable nuclear PTC portfolio results and favorable labor (incentives), contracting and materials partially offset by unfavorable market and portfolio conditions and impacts of nuclear outages.

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Constellation Energy’s strategic investment plans and focus on continuing to expand its renewable portfolio drive its earnings performance. The company surpassed expectations in all the last four quarters, with an average earnings surprise of 10.16%.

Image Source: Zacks Investment Research

CEG stock closed at $284.44 on Feb. 21. In the past year, the company’s shares have gained 113.5% compared with the industry’s 65.9% rally. CEG has also outperformed the S&P 500’s growth of 19.7% and the Zacks Oil-Energy sector’s return of 4.8%.

Price Performance (One Year)

Image Source: Zacks Investment Research

Is it a good time to add this alternate energy stock to your portfolio? To assess, let’s delve deep into the factors influencing the increase in share price, review the third-quarter results and evaluate the stock’s investment potential.

Highlights of CEG Stock’s Q4 Release

Constellation Energy achieved a nuclear operating capacity factor of 94.8% for the fourth quarter of 2024. The high availability of the nuclear units ensures a consistent high volume of clean energy supply for customers.

Constellation Energy continues to return capital to its shareholders and repurchased shares worth $1 billion in 2024 and $1 billion of remaining authority to repurchase shares under the program.

Total operating expenses were $4.48 billion, down 23.6% from $5.86 billion in the year-ago period. Operating income totaled $972 million against an operating loss of $67 million in the year-ago quarter.

Just after fourth-quarter end, Constellation Energy entered into a definitive agreement to acquire Calpine Corporation. This will combine the largest producer of clean, emissions-free energy with Calpine’s reliable, dispatchable natural gas assets. It will also create the nation’s leading competitive retail supplier poised to meet the growing demand from customers and communities. The deal is composed of 50 million shares of CEG’s common stock and $4.5 billion in cash.

Constellation Energy’s Earnings Estimates Moving North

The Zacks Consensus Estimate for Constellation Energy’s 2025 and 2026 earnings per share has increased 1.9% and 2.8%, respectively, in the past 60 days.

Image Source: Zacks Investment Research

Factors Contributing to CEG Stock’s Strong Performance

Constellation Energy’s strategic investment plans and its focus on continuing to expand its renewable portfolio drive its earnings performance. It expects capital expenditures of nearly $3 billion and $3.5 billion for 2025 and 2026, respectively. Nearly 35% of projected capital expenditures are for the acquisition of nuclear fuel, which includes additional nuclear fuel to increase inventory levels.

Operating nuclear-powered generating units provides an additional advantage to Constellation Energy. Nuclear plants can reliably produce carbon-free energy 24/7 in all weather conditions and run for up to two years without needing to be refueled. These plants are a perfect fit to provide 24/7 electricity to the rising clean power demand from AI-driven data centers.

The company is all set to take advantage of the growing demand from data centers. As per a Business Insider report, major tech companies are expected to invest $1 trillion in data centers over the next five years. In September 2024, CEG executed a 20-year PPA with Microsoft Corporation (MSFT – Free Report) that will support the restart of Three Mile Island Unit 1, renamed the Crane Clean Energy Center. Under the agreement, Microsoft will purchase the output generated from the renewed plant.

CEG Stock Returns Better Than Industry

Constellation Energy’s trailing 12-month return on equity of 21.96% is better than the industry average of 8.44%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Image Source: Zacks Investment Research

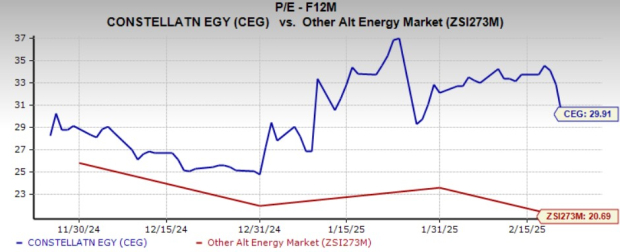

CEG Stock Trades at a Premium

Constellation Energy is currently trading at a premium compared with its industry on a forward 12-month P/E basis.

Image Source: Zacks Investment Research

Another company, Vistra Corp. (VST – Free Report) , which also has substantial nuclear power generation capacity, is trading at a premium compared to its industry on a forward 12-month P/E basis.

Wrapping Up

Constellation Energy is benefiting from the increasing demand for clean energy in its service territories, driven by the development of AI-driven data centers. CEG’s strong production capacity and high nuclear capacity factor allow it to meet rising demand, and the company reported positive earnings surprises in the trailing four quarters.

Investors can think about adding this Zacks Rank #2 (Buy) stock to their portfolio and enjoy the benefits of dividends, share buybacks and rising earnings estimates.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.