Shares of Ford Motor Company (NYSE: F) have bucked the downward trend that has afflicted the rest of the market recently. While the broad consumer discretionary sector posted a loss of -15.29% over the past month — the worst among the S&P 500’s 11 sectors — Ford posted a gain of 2.48% over the same period. Year-to-date, the stock has barely broken even with a 0.62% gain, yet it remains down -19.62% over the past year -61.45% since its five-year high on Jan. 14, 2022.

On March 14, the company announced it hired Mike Aragon, a former Lululemon executive, to serve as president of integrated services business segment as Ford seeks to create more revenue via subscriptions and other software-enabled features. When the company reported year-end results, Ford announced a 4.2% increase in U.S. vehicle sales during 2024, reaching a total of 2,078,832 units. This growth was driven by sales increases across both the Ford and Lincoln brands. Additionally, Ford expanded its market share to 12.6% from 12.4% in the previous year.

The legacy automaker’s iconic brand helped to define American mechanical design and business supremacy in the 20th century and continues to remain a major player to this day. Founder Henry Ford created the mass production assembly line manufacturing process, and Ford cars and trucks are sold worldwide. It is the second-largest US auto industry builder after General Motors and sixth largest worldwide.

The Dearborn-headquartered company has remained resilient and has continues to stay competitive with its 6.19% annual dividend yield. But investors are concerned with future stock performance over the next 1, 5 and 10 years. While most Wall Street analysts will calculate 12-month forward projections, it’s clear that nobody has a consistent crystal ball, and plenty of unforeseen circumstances can render even near-term projections irrelevant. 24/7 Wall Street aims to present some farther-looking insights based on Ford’s own numbers, along with business and market development information that may be of help to our readers’ own research.

While longtime Ford investors may have benefited from Ford’s dividend, its stock price clearly has not experienced the recent exponential growth of Magnificent 7 stocks, like Nvidia or Microsoft. The last time Ford had a strong bull run was during the pandemic in March 2020, when the stock soared from an aberrantly low $4.27 to $25 in January 2022, before settling back into its current range in mid-2022, where it has remained ever since. Apart from that last 500% gain, past comparable periodic rise and falls of Ford stock price can be traced back historically going back decades.

Fiscal Year

Price

Revenues

Net Income

2014

$16.13

$135.378B

$1.23B

2015

$11.17

$140.56B

$7.37B

2016

$12.38

$141.54B

$4.59B

2017

$10.43

$145.66B

$7.73B

2018

$8.71

$148.321B

$3.67B

2019

$8.31

$143.64B

$47M

2020

$11.51

$115.94B

-$1.28B

2021

$17.96

$126.27B

$17.93B

2022

$13.23

$149.08B

-$1.98B

2023

$12.80

$165.90B

$4.34B

2024

$9.65

$184.99B

$5.88B

According to 15 Wall Street analysts, Ford is assigned a “Hold,” with four buy recommendations, nine hold recommendations and two sell recommendations. The one-year price target is $10.71, which represents 10.64% upside potential from today’s price.

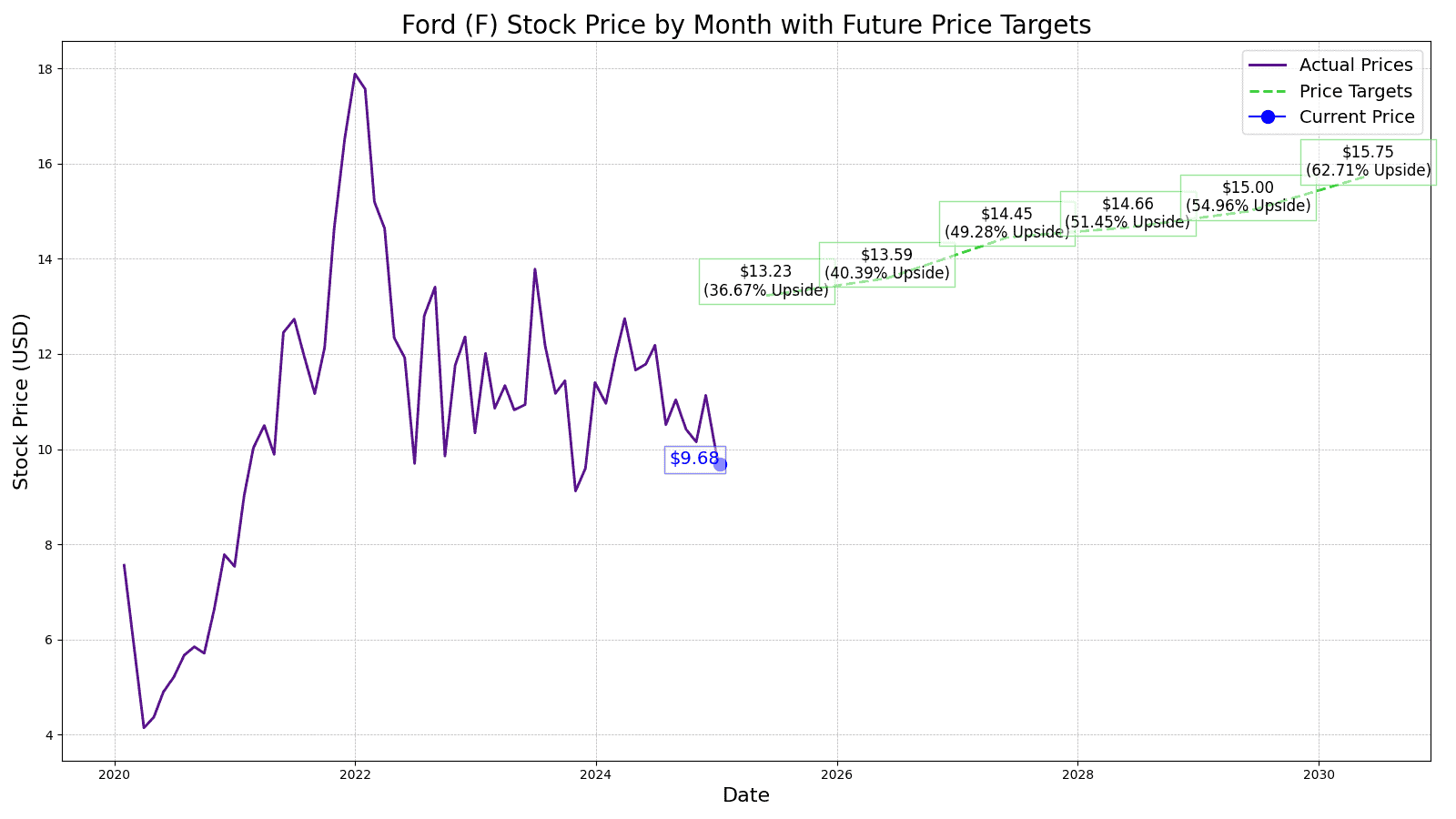

However, 24/7 Wall Street’s one-year price target for Ford is $13.23, representing 36.67% upside potential. We believe this is a conservative estimate based on the implementation of Ford’s changes and the uncertain impact on automakers of President Trump’s tariffs, as well as his reversal of EV incentives.

2030 could see some new developments from Ford Pro AV development and non-vehicular markets as well as other R&D, resulting in an approximate $10 billion revenue increase and a commensurate stock price hike to $15.75. This would equate to a nearly 63.21% gain over the present market price for Ford.

Year

Stock Price

%Change From Current Price

2025

$13.23

36.67%

2026

$13.59

40.39%

2027

$14.45

49.28%

2028

$14.66

51.45%

2029

$15.00

54.96%

2030

$15.75

62.71%

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

Financial Market Newsflash

No financial news published today. Check back later.