Advanced Micro Devices (AMD – Free Report) recently expanded its x86 embedded processor portfolio with the launch of the fifth-generation EPYC family server of processors. The company also expanded its gaming offering with the AMD Radeon RX 9070 XT and RX 9070 graphics cards.

Through its embedded EPYC portfolio, AMD supports high-performance compute, high-bandwidth network connectivity and security, and high-performance storage requirements for enterprise and cloud infrastructure. The latest processors help networking, storage and industrial edge systems to process more data, faster and with greater efficiency. Meanwhile, AMD Radeon RX 9070 XT and RX 9070 graphics cards, part of the Radeon RX 9000 Series, are based on the much-anticipated AMD RDNA 4 graphics architecture.

However, will the latest additions help AMD stock recover in the near term? The company has been suffering from stiff competition from NVIDIA (NVDA – Free Report) in the cloud-data center and AI chip markets. Growing demand for custom AI chips offered by the likes of Broadcom is increasing concern over market share.

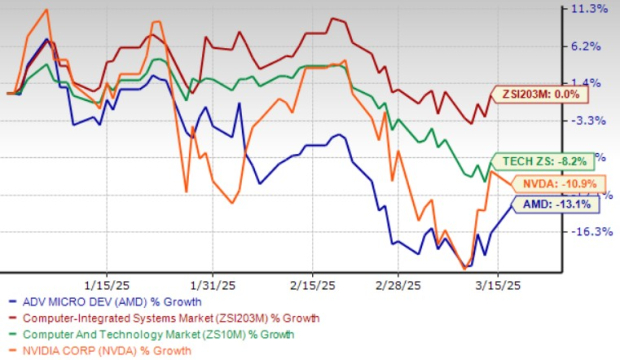

AMD Stock’s Performance

Image Source: Zacks Investment Research

AMD shares have lost 13.1% year to date, underperforming the Zacks Computer and Technology sector’s decline of 8.2% and the Zacks Computer – Integrated Systems industry’s 0.0%.

AMD has been relying on its portfolio of fifth-gen EPYC Turin, fourth-gen and third-gen EPYC processors, as well as Instinct accelerators and ROCm software suite to fight off competition of NVIDIA, shares of which have dropped 10.9% year to date.

In 2024, AMD’s Data Center revenues accounted for roughly 50% of annual revenues and jumped 69% year over year to $3.9 billion. EPYC instances increased 27% in 2024 to more than 1000, with hyperscalers like Amazon Web Services, Alibaba, Google, Microsoft and Tencent launching more than 100 general-purpose AI instances in the fourth quarter of 2024 alone.

Can AMD’s Latest Processors Aid Revenue Growth?

AMD EPYC Embedded 9005 Series processors support core counts from 8 to 192 in a single socket and deliver up to 1.3X and 1.6X increase in data processing throughput for networking and storage workloads, respectively.

These features of AMD’s latest processors make them ideal for network and security firewall platforms, storage systems and industrial control applications. These processors have capacity of up to 6TB of DDR5 memory per socket and expanded I/O connectivity, supporting up to 160 PCIe Gen5 lanes with CXL 2.0. These enable storage capacity expansion and high-speed data transfers for networking and storage applications.

AMD’s latest graphics cards feature 16GB of memory, re-vamped raytracing accelerators and powerful AI accelerators, making it suitable for hard-core gaming. Apart from gaming, the RX 9000 Series GPUs leverage new second-generation AI accelerators with up to 8x INT8 throughput per AI accelerator to enhance creative applications and effectively run Generative AI (Gen AI) applications.

The additions are expected to drive top-line growth for Embedded and Gaming segment. For 2025, AMD expects a modest increase in revenues for the Gaming and Embedded businesses.

Rich Partner Base & Acquisitions to Boost AMD’s Prospects

A rich partner base that includes Cisco Systems (CSCO – Free Report) , International Business Machines (IBM – Free Report) , Amazon, Alibaba, Google, Microsoft, Meta Platforms, Dell Technologies and Tencent has been playing a key part in expanding AMD’s footprint.

Cisco has selected AMD EPYC Embedded 9005 Series processor for one of its high-end firewall products, while IBM Storage Scale System 6000 is leveraging the processor due to the introduction of redundant paths for high data availability and robust connectivity options.

AMD has been on an acquisitive spree to strengthen its AI ecosystem and bridge the technological gap with NVIDIA in the race for AI dominance. The acquisition of Helsinki-based Silo AI-enhanced AMD’s AI development capabilities. The acquisition of ZT Systems, which provides AI infrastructure to large hyperscale computing companies, enables AMD to simultaneously design and validate its next-generation AI silicon and systems.

AMD’s 2025 Earnings Estimates Trend Downward

The Zacks Consensus Estimate for AMD’s 2025 earnings is currently pegged at $4.59 per share, down by a penny over the past 30 days, indicating year-over-year growth of 38.67%.

The consensus mark for 2025 revenues is pegged at $31.87 billion, indicating year-over-year growth of 23.61%.

AMD beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 2.32%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

AMD Stock Overvalued

AMD stock is currently overvalued, as the Value Score of D suggests a stretched valuation at this moment.

The stock is trading at a premium, with a forward 12-month Price/Sales of 5.12X compared with the industry’s 3.07X.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

AMD Stock: Buy, Sell or Hold?

AMD’s expanding portfolio and strategic acquisitions are expected to improve its top-line growth. However, its near-term prospects are dull, given the weakness in the Gaming and Embedded segment and stiff competition from NVIDIA in the Data Center space. This is expected to remain an overhang on the shares in the near term.

Stretched valuation is a concern. The stock is trading below the 50-day and 200-day moving averages, indicating a bearish trend.

AMD Stock Trading Below 50-Day & 200-Day SMA

Image Source: Zacks Investment Research

AMD currently has a Zacks Rank #3 (Hold), suggesting that it may be wise for investors to wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.