Spotify Technology S.A. (SPOT – Free Report) shares have skyrocketed 130% in a year, outperforming the 15.4% rally of its industry. Spotify’s music streaming rivals have also seen gains over the past year, with Apple (AAPL – Free Report) rising 29%, Amazon (AMZN – Free Report) 13%, and Alphabet (GOOGL – Free Report) 12%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

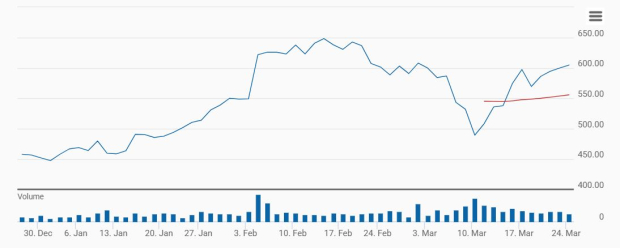

The stock is trading above its 50-day moving average, indicating bullish sentiment among investors.

SPOT Stock Trades Above 50-Day Average

Image Source: Zacks Investment Research

Given the rise in SPOT’s shares, investors may feel inclined to ride the rally. However, the crucial question remains: Is this the right time to invest in Spotify? Let us evaluate.

Content Quality, Price Hikes are SPOT’s Growth Drivers

A high-quality content inventory significantly boosts monthly active users (MAU), driving its revenues. In addition to that, the annual Wrapped campaign is a major driver behind MAU and subscriber growth. In the fourth quarter of 2024, MAU increased by 35 million to 675 million in total, surpassing the management’s previously provided guidance by 10 million. Furthermore, premium revenues grew 19% year over year, driven by pricing power on the new user growth, suggesting that a bulk of new active user growth is high-quality paying users that have significant average revenue per user upside once the premium features begin to get monetized.

Spotify’s performance has been bolstered by sustained price hikes, a loyal consumer base and significant cost reductions. The ability to raise prices while retaining and expanding its subscriber base is particularly noteworthy. So far, price hikes have had little to no effect on slowing new subscriber demand. As streaming services keep raising prices, Spotify’s increases blend in with the competition.

SPOT’s Strong Returns on Capital

Spotify has demonstrated strong capital efficiency, with a trailing 12-month return on invested capital of 23.55%, surpassing the industry average of 21.87%. This highlights the company’s effective allocation of resources to generate profitable growth. A higher ROIC suggests that Spotify is utilizing its investments more efficiently than many of its peers, reinforcing its competitive edge in the streaming industry. Consistently strong ROIC figures indicate sound financial management and the potential for sustained long-term profitability.

Spotify’s Strong Top & Bottom-Line Prospects

Spotify’s growth outlook remains strong, with the Zacks Consensus Estimate projecting revenues of $18.9 billion in 2025 and $21.7 billion in 2026, reflecting year-over-year growth of 11.2% and 14.9%, respectively. EPS estimates stand at $10.2 for 2025 and $13.1 for 2026, representing significant increases of 71.9% and 28% year over year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

These projections indicate Spotify’s ability to expand its revenue base while improving profitability. Strong revenue and earnings growth suggest that the company is effectively scaling its business within the highly competitive music-streaming industry.

Buy Spotify

Spotify’s remarkable stock rally, driven by strong financial performance and strategic growth initiatives, makes it an attractive investment. The company’s ability to expand its user base, implement price hikes without losing subscribers, and enhance revenue per user highlights its competitive strength.

With efficient capital allocation and a solid growth outlook, Spotify continues to scale its business while improving profitability. As it strengthens its premium offerings and maintains operational efficiency, the company remains well-positioned for long-term success. Given its strong fundamentals and industry leadership, Spotify is a Buy for investors looking to capitalize on the streaming market’s potential.

Spotify carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.