FMC Corporation (FMC – Free Report) recently entered into a partnership with Bayer to bring Isoflex active herbicide technology to the European Union (EU) and Great Britain. This partnership will also expand FMC’s breakthrough weed control technology’s access throughout European markets.

The Herbicide Resistance Action Committee classified Isoflex active as a Group 13 herbicide. It has already received registration in Great Britain in 2024 and is pending EU registration, which is anticipated in 2025.

This herbicide offers European growers a powerful new solution for resistant grass weeds in cereals and other crops. It is expected to provide lasting control of key grass weeds, including those resistant to other herbicides, addressing a critical need in European agriculture. This market expansion will allow FMC access to an estimated 30 million planted hectares of winter cereals, bringing the Isoflex active ingredient to new growers and distributors.

FMC intends to commercialize its own formulations, and both companies will bring products containing Isoflex active to the winter cereals and oilseed rape markets. Under the terms of the agreement, Bayer will submit registrations and commercialize mixtures having Isoflex active and distribute the formulation developed by FMC for use in oilseed rape. The companies will jointly promote the Isoflex active brand. The product launches are anticipated in Great Britain later this year and in the EU in 2027, eventually contributing to food security.

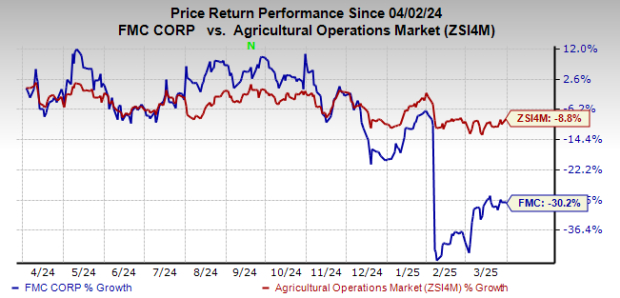

The FMC stock has lost 30.2% over the past year compared with the 8.8% decline in the industry.

Image Source: Zacks Investment Research

FMC’s Zacks Rank and Key Picks

FMC currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the Basic Materials space are Ingevity Corporation (NGVT – Free Report) , Axalta Coating Systems (AXTA – Free Report) and Carpenter Technology Corporation (CRS – Free Report) . While NGVT and AXTA sport a Zacks Rank #1 (Strong Buy) each at present, CRS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ingevity’s current-year earnings is pegged at $4.45 per share. NGVT’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average surprise being 202.9%.

The Zacks Consensus Estimate for Axalta’s current-year earnings is pegged at $2.51 per share. AXTA’s earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, with an average surprise of 16.28%.

The Zacks Consensus Estimate for Carpenter Technology’s current fiscal-year earnings is pegged at $6.95 per share. CRS’ earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 15.7%. Its shares have soared 156.6% in the past year.

Financial Market Newsflash

No financial news published today. Check back later.