The Goldman Sachs Group, Inc. (GS – Free Report) is scheduled to release first-quarter 2025 earnings on April 14 before the opening bell.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Goldman’s close peer JP Morgan (JPM – Free Report) is slated to announce quarterly numbers on April 11, whereas Morgan Stanley (MS – Free Report) is expected to come out with its performance details on April 15.

In the fourth quarter of 2024, Goldman’s results benefited from the strength in the investment banking (IB) business. However, a rise in provisions was concerning.

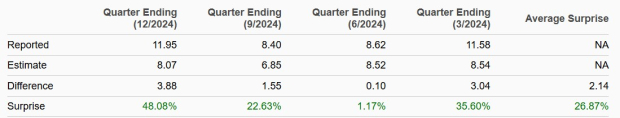

Goldman has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, with an average earnings surprise of 26.87%.

Earnings Surprise History

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let us see how GS is expected to fare in terms of revenues and earnings this time.

The Zacks Consensus Estimate for first-quarter 2025 revenues is pegged at $15.16 billion, calling for a 6.6% rise from the year-ago quarter’s reported figure.

In the past seven days, the consensus estimate for quarterly earnings has been revised downward to $12.72 per share. However, the projection suggests a rally of 9.8% from the year-ago quarter’s reported figure.

Estimate Revision Trend

Image Source: Zacks Investment Research

Factors to Shape GS’s Q1 Results

Market-Making Revenues: The first quarter saw solid client activities and market volatility. The uncertainty surrounding the impacts of tariffs on the U.S. economy and the Fed’s monetary policy drove client activity as investors shifted to safe investment options. Additionally, volatility was high in equity markets and other asset classes, including commodities, bonds and foreign exchange. Therefore, Goldman’s market-making revenues are likely to have witnessed a rise in the quarter to be reported.

IB Fees: Global merger and acquisition (M&A) activities in the first quarter of 2025 underperformed prior expectations, with modest growth driven mainly by the Asia Pacific region. The initial optimism of robust IB performance on the back of the Trump administration being business-friendly, and the likelihood of tax cuts and deregulations quickly faded amid trade tensions and tariff uncertainties. This led to significant market volatility and economic uncertainty. As a result, companies became more cautious about pursuing M&A despite stabilizing rates and ample capital.

The IPO market saw signs of cautious optimism, given the market volatility and geopolitical challenges. The subdued equity market performance led to weak activity in follow-up equity issuances. Bond issuance volume was weak for similar reasons. Nonetheless, GS’s leadership position in worldwide announced and completed M&As, equity and equity-related offerings, and common stock offerings is likely to have provided it an edge over its peers, offering some support to the company’s quarterly IB revenues.

The Zacks Consensus Estimate for IB fees of $1.88 billion indicates an 8.8% decline from the prior quarter’s reported level.

Net Interest Income (NII): An uncertain macroeconomic backdrop because of Trump’s tariff plans is likely to have resulted in a decent lending scenario. Per the Fed’s latest data, the demand for commercial and industrial, real estate, and consumer loans was modest in the first two months of the quarter. Hence, loan growth for Goldman is likely to have been decent.

In the first quarter, the Federal Reserve kept interest rates unchanged at 4.25-4.5%. This is likely to have offered some support to Goldman’s net interest income (NII) as the funding/deposit costs stabilized.

The Zacks Consensus Estimate for NII is pegged at $4.67 billion, suggesting significant growth from the $2.35 billion reported in the prior quarter.

Expenses: Goldman’s investments in technology and market development expenses for business expansion and a rise in transaction-based expenses due to higher client activity are anticipated to have led to increased expenses in the to-be-reported quarter.

What Our Model Unveils for Goldman

Per our proven model, the chances of GS beating estimates this time are high. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here, as you can see below.

Goldman has an Earnings ESP of +0.89%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

GS carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

GS’s Price Performance & Valuation

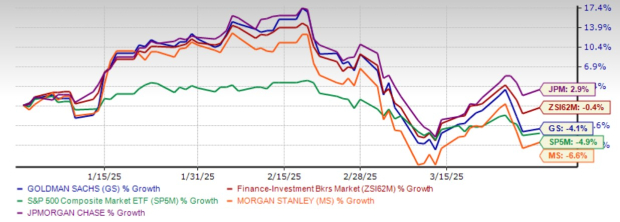

In the first quarter of 2025, Goldman’s shares underperformed its industry while outperforming the S&P 500 index.

GS performed worse than JPMorgan, but it outpaced Morgan Stanley. JPM rose 2.9%, while MS fell 6.6% during the same time frame.

1Q25 Price Performance

Image Source: Zacks Investment Research

Let us look at the value GS offers investors at the current levels.

Currently, Goldman is trading at 9.78X forward 12-month price/earnings. Meanwhile, the industry’s forward earnings multiple sits at 10.59X. The company’s valuation looks somewhat inexpensive compared with the industry average.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

GS is trading at a discount compared with its peers JP Morgan’s forward 12-month earnings of 16.71X and Morgan Stanley’s forward 12-month earnings of 14.47X.

How to Play Goldman Stock Now

The company’s efforts to refocus on the IB and trading businesses provide a solid base for growth in the upcoming period. Goldman is also expected to benefit from leniency in approving merger deals under the Trump administration. Its leadership position in announced and completed M&As gives it an edge over its peers.

Goldman plans to ramp up its lending services to private equity and asset managers, and aims to expand internationally. Goldman Asset Management — a unit of GS — intends to expand its private credit portfolio to $300 billion in five years, positioning it for long-term growth.

The company’s strong liquidity position supports its capital distribution activities. GS continues to reward its shareholders handsomely. In July 2024, it increased its common stock dividend 9.1% to $3 per share. In the past five years, the company has hiked dividends four times, with an annualized growth rate of 23.60%. Currently, its payout ratio sits at 30% of earnings.

While Goldman’s solid fundamentals and strong prospects remain promising, investors should not rush to buy the stock. The company’s rising expenses and bearish analyst sentiments warrant caution.

To get clarity and possibly an appealing entry point, those interested in adding the GS stock to their portfolios might be better off waiting until after the quarterly results are out. Also, they should keep an eye on macroeconomic factors that are likely to influence the company’s performance. Those who already own the GS stock can consider retaining it because it is less likely to disappoint over the long term.

Financial Market Newsflash

No financial news published today. Check back later.