Citigroup Inc. (C – Free Report) is slated to report first-quarter 2025 results on April 15, 2025, before market open.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Among Citigroup’s close peers, JPMorgan (JPM – Free Report) and Wells Fargo & Company (WFC – Free Report) are scheduled to announce quarterly numbers on April 11.

In the fourth quarter, Citigroup witnessed a rise in total loan balance. The company registered a solid increase in Investment Banking (IB) revenues. However, declines in the deposit balance and net interest income (NII) were concerning.

This globally diversified financial services holding company is expected to register bottom and top-line increases in the to-be-reported quarter.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $21.14 billion, indicating a year-over-year rise of 0.2%.

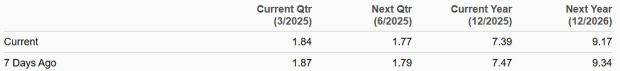

The consensus estimate for earnings for the to-be-reported quarter has been revised downward to $1.84 over the past seven days. The figure indicates a 16.5% rise from the prior-year quarter’s actual.

Estimate Revision Trend

Image Source: Zacks Investment Research

The company also has an impressive earnings surprise history. Its earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 17.07%.

Earnings Surprise History

Image Source: Zacks Investment Research

Factors to Influence Citigroup’s Q1 Results

NII: In the first quarter, the Federal Reserve kept interest rates unchanged at 4.25-4.5%. This is likely to have offered some support to Citigroup’s NII as the funding/deposit costs stabilized.

The Zacks Consensus Estimate for NII is pinned at $13.7 billion, suggesting a 1.4% year-over-year rise.

Loans: An uncertain macroeconomic backdrop because of Trump’s tariff plans is likely to have resulted in a decent lending scenario. Per the Fed’s latest data, the demand for commercial and industrial, and consumer loans was modest in the first two months of the quarter. Hence, C is expected to have witnessed a decent rise in loan demand, thereby improving the average interest-earning asset balance. Similarly, JPMorgan and Wells Fargo are likely to have recorded a marginal improvement in loan demand.

The Zacks Consensus Estimate for Citigroup’s average interest-earning assets is pegged at $2.26 trillion, indicating a marginal increase from the prior-year quarter’s reported figure.

Fee Income: Global merger and acquisition (M&A) activity in the first quarter of 2025 underperformed prior expectations, but witnessed modest growth driven mainly by the Asia Pacific region. The initial optimism of robust IB performance on the back of the Trump administration being business-friendly, and the likelihood of tax cuts and deregulations, quickly faded amid trade tensions and tariff uncertainties. This led to significant market volatility and economic uncertainty. As a result, companies became more cautious about pursuing M&A despite stabilizing rates and ample capital.

Nonetheless, the first quarter saw solid client activities and market volatility. The uncertainty surrounding the impacts of tariffs on the U.S. economy and the Fed’s monetary policy drove client activity as investors shifted to safe investment options. Additionally, volatility was high in equity markets and other asset classes, including commodities, bonds and foreign exchange. Therefore, Citigroup’s market-making revenues are likely to have witnessed a rise in the quarter to be reported.

The Zacks Consensus Estimate for markets revenues is pegged at $5.57 billion, which suggests a 6.9% increase on a year-over-year basis.

The Zacks Consensus Estimate for income from commissions and fees is pegged at $2.66 billion, which indicates a 2.3% decline on a year-over-year basis.

The Zacks Consensus Estimate for income from principal transactions is pegged at $3.54 billion, which indicates an 8.2% increase from the prior-year quarter’s actual.

The Zacks Consensus Estimate for administration and other fiduciary fees is pegged at $1.09 billion, which indicates a year-over-year rise of 4.9%.

The Zacks Consensus Estimate for total non-interest income for the first quarter of 2025 is pegged at $7.54 billion, which suggests a marginal decrease from the prior-year quarter’s actual.

Expenses: Continued investments in the transformation of its underlying technology, risk management and internal controls as part of remediation highlighted by the Office of the Comptroller of the Currency and the Federal Reserve are expected to have kept the expense base elevated in the first quarter of 2025.

Asset Quality: The company is likely to have set aside a huge amount of money for potential delinquent loans, given the expectations of higher for longer interest rates, and the impacts of Trump’s tariffs on inflation.

The Zacks Consensus Estimate for non-accrual loans is pegged at $3.61 billion, indicating a jump of 30.3% from the prior year’s reported figure.

What Our Model Unveils for C

Per our proven model, the chances of Citigroup beating estimates this time are high. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is the case here, as you can see below.

Citigroup has an Earnings ESP of +0.26%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

The company carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Citigroup’s Price Performance & Valuation

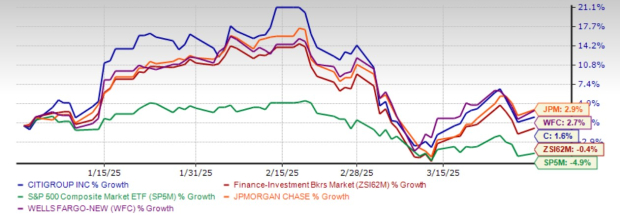

In the first quarter of 2025, C shares gained 1.6% against the industry and the S&P 500 Index’s decline of 0.4% and 4.9%, respectively. Shares of JP Morgan and Wells Fargo gained 2.9% and 2.7%, respectively, in the same period.

Price Performance

Image Source: Zacks Investment Research

Now, let us look at the value Citigroup offers investors at current levels.

Currently, C is trading at 8.07X forward 12-month earnings, below the industry’s forward price/earnings (P/E) multiple of 10.59X. The company’s valuation looks inexpensive compared with the industry average.

Price-to-Earnings F12M

Image Source: Zacks Investment Research

Citigroup stock is also trading at a discount compared with JPMorgan’s P/E of 12.72X and Wells Fargo’s P/E of 10.82X.

Evaluating Citigroup Stock Ahead of Q1 Earnings

Citigroup has been streamlining operations internationally to enhance its focus on core areas and drive fee-based income growth. In sync with this, in December 2024, it completed the separation of its institutional banking operations in Mexico from its consumer businesses. In June 2024, C sold its China-based onshore consumer wealth portfolio to HSBC China — a wholly owned subsidiary of HSBC Holdings plc. With these initiatives, the company projects revenues to witness a compound annual growth rate (CAGR) of 4-5% by 2026-end.

The company is executing a sweeping overhaul of the bank to enhance its performance, reduce costs and simplify business operations. In sync with this, in January 2024, C announced the plan to eliminate 20,000 jobs as part of its broad-scale restructuring effort over the next two years. Through such moves, Citigroup is expected to drive $2-$2.5 billion of annualized run rate savings by 2026.

Citigroup also rewards shareholders handsomely. In July 2024, the company hiked its quarterly dividend by 6% to 56 cents per share. On Jan. 13, 2025, Citigroup’s board of directors approved a $20-billion common stock repurchase program with no expiration date. The bank aims to repurchase $1.5 billion of its common stock in the first quarter of 2025.

Although C is focused on lowering expenses through organizational simplification and headcount reduction, the bank’s increased investments in business transformation efforts, technological advancements are likely to keep the expense base elevated in the near term. Fears of recession and the expectations of higher for longer interest rates given Trump’s tariffs and economic slowdown might cause a decline in loan demand and a rise in delinquency rates. This is worrisome for Citigroup.

Hence, investors should not rush to buy the stock now. To get clarity and possibly an appealing entry point, those interested in adding it to their portfolios might be better off waiting until after the quarterly results are out. Also, potential investors should keep an eye on macroeconomic factors that are likely to influence the company’s performance. Those who already own the C stock can consider retaining it because it is less likely to disappoint over the long term.

Financial Market Newsflash

No financial news published today. Check back later.