Verizon Communications Inc. (VZ – Free Report) recently achieved a significant 5G network speed breakthrough with a 5.5 gigabit per second (Gbps) download speed. The trial was undertaken in a 5G lab environment in association with Samsung Electronics Co., Ltd., and MediaTek using carrier aggregation – a technology that combines multiple channels of both FDD (Frequency Division Duplex) and TDD (Time Division Duplex) spectrum bands for greater data transmission efficiency over wireless networks.

Virtualization Technology: A Gamechanger for VZ?

Virtualization technology enables the creation of multiple simulated environments or dedicated resources from a single physical hardware system. Over the last few years, Verizon has shifted toward cloud-based architecture, virtualization and O-RAN (open-radio access network) integration as part of its extensive network modernization efforts. The deployment of a cloud-native, container-based, virtualized architecture has led to increased flexibility, scalability and cost efficiency across Verizon’s network.

Furthermore, Verizon’s early adoption of VRAN (Virtualized Radio Access Network) serves as a precursor to O-RAN integration. By virtualizing core network functions and baseband units, Verizon has laid a robust foundation for future deployment flexibility and rapid integration of services.

The seamless integration of O-RAN into Verizon’s network architecture is poised to revolutionize the telecommunications landscape. This transition not only underscores Verizon’s commitment to technological advancement but also positions the company at the forefront of innovation within the industry.

Wireless Traction Buoys Verizon

With one of the most efficient wireless networks in the United States, Verizon delivers faster peak data speeds and capacity for customers, driven by customer-focused planning, disciplined engineering and steady infrastructure investments. The company’s 5G network hinges on three fundamental drivers to deliver the full potential of next-generation wireless technology. These include massive spectrum holdings, particularly in the millimeter-wave bands for faster data transfer, end-to-end deep fiber resources and the ability to deploy a large number of small cells.

Verizon is witnessing significant 5G adoption and fixed wireless broadband momentum with premium unlimited plans. The telecom giant plans to accelerate the availability of its 5G Ultra Wideband network across the country. The company’s growth strategy includes 5G mobility, nationwide broadband and mobile edge compute and business solutions.

Verizon Plagued by Margin Woes

Despite solid wireless traction, the company’s wireline division is struggling with persistent losses in access lines due to competitive pressure from voice-over-Internet protocol service providers and aggressive triple-play (voice, data, video) offerings by the cable companies. Moreover, to expand its customer base, Verizon is spending heavily on promotion and offering lucrative discounts, which are weighing on margins.

VZ also recorded high capital expenditures to support the launch and continued build-out of its 5G Ultra Wideband network, deployment of significant fiber assets across the country and upgrade to Intelligent Edge Network architecture. The company has splurged in the C-Band auction, which is offering airwaves in the 3.7 gigahertz-to-4.2 gigahertz area of spectrum to acquire key mid-band spectrum for potential 5G deployments in the next few years. Unless the high auctioning expenses are justified, margins are likely to be compromised significantly.

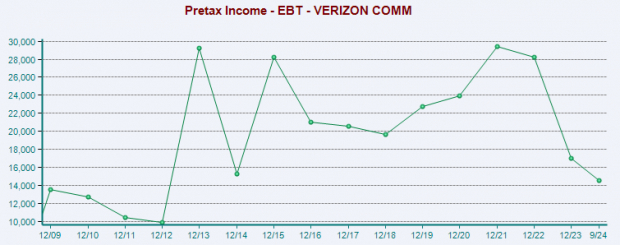

Image Source: Zacks Investment Research

Competitive Pressure, Eroding Legacy Services Weigh on VZ

The company operates in a competitive and almost saturated U.S. wireless market. Spectrum crunch has become a major issue in the U.S. telecom industry. Most carriers are finding it increasingly challenging to manage mobile data traffic and video streaming demand, which is growing by leaps and bounds.

In addition, Verizon is facing a steady decline in legacy services. The company registered 74,000 Fios Video net losses in the third quarter of 2024, reflecting the ongoing shift from traditional linear video to over-the-top offerings.

Price Performance of VZ Stock

VZ has declined 0.5% over the past year against the national wireless industry’s growth of 36%, lagging peers like AT&T Inc. (T – Free Report) and T-Mobile US Inc. (TMUS – Free Report) .

VZ Stock One-Year Price Performance

Image Source: Zacks Investment Research

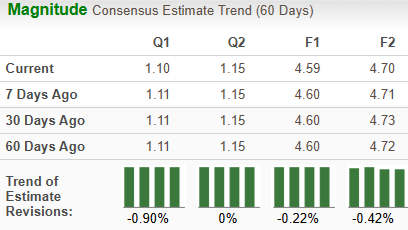

Earnings Estimate Revision Trend of VZ

Earnings estimates for Verizon for 2024 have remained steady at $4.60 over the past year, while the same for 2025 has declined marginally to $4.71. These portray a cautious approach to the stock.

Image Source: Zacks Investment Research

End Note

By investing steadily in infrastructure and pioneering new technologies, Verizon is well-positioned to bridge the digital divide and enhance the connectivity landscape nationwide. This is likely to translate into solid subscriber growth, higher average revenue per user and increased broadband and fiber penetration.

However, a saturated wireless market and price wars owing to competitive pressure have eroded its profitability. The marginal downtrend in estimate revisions further portrays skepticism about the stock’s growth potential. With a Zacks Rank #3 (Hold), Verizon appears to be treading in the middle of the road, and investors could be better off if they trade with caution. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.