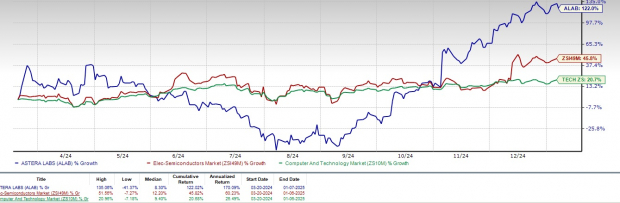

Astera Labs (ALAB – Free Report) shares have surged 122% since IPO period, outperforming the broader Zacks Computer & Technology sector’s return of 20.7% and the Zacks Electronics – Semiconductors industry’s appreciation of 45.8%.

Astera Lab’s outperformance can be attributed to the increasing demand for AI servers and data center infrastructure.

ALAB’s top-line growth is driven by the continued ramp-up of multiple product families, particularly in AI platforms utilizing both third-party GPUs and internally developed AI accelerators.

ALAB Outperforms Sector

Image Source: Zacks Investment Research

ALAB Capitalizes on AI Growth and PCIe Retimers Market

ALAB’s increasing demand for AI platforms, particularly those leveraging high-performance GPUs and AI accelerators, drove strong design wins and sales for products like Aries Retimers, Taurus Smart Cable Modules, and Scorpio Fabric Switches.

ALAB introduced its Scorpio Smart Fabric Switches, purpose-built for AI infrastructure at cloud scale, featuring P-Series for PCIe Gen 6 connectivity and X-Series for GPU clustering. Scorpio is expected to significantly enhance Astera Labs’ total market opportunity, which is projected to exceed $12 billion by 2028.

The company’s robust PCIe retimers under the Aries product line highlight significant growth opportunities. With increasing demand for advanced connectivity solutions, Aries retimers are positioned as a critical enabler for businesses looking to enhance the performance of their AI systems.

ALAB’s expanding portfolio is helping it fend off competition from other industry players like Broadcom (AVGO – Free Report) , which is also making strong efforts in the PCIe retimers market. Broadcom shares have gained 80.6% since IPO.

Astera Labs Powers AI Advancements With Top Chipmakers

Astera Labs has made a significant impact on the AI industry with collaborations with top chipmakers, including NVIDIA (NVDA – Free Report) , Advanced Micro Devices (AMD – Free Report) , Micron Technology, and Intel.

Astera Labs products are used in NVIDIA’s GB200 product. It is expected that the PCIe switch may play a key role in future NVIDIA products. This collaboration further emphasizes the influence of Astera Labs in the development of advanced AI technologies.

AMD also continues to utilize Astera Labs solutions to enhance the efficiency and scalability of its AI-driven products. The partnership strengthens both companies’ positions in the AI market, fueling advancements in next-gen technologies.

ALAB’s Earnings Estimates Show Upward Movement

ALAB’s continued demand for its AI-related products and an expanding customer base are expected to drive top-line growth.

The company continues to expect strong growth from the Aries product family across diverse AI platforms, ramping Taurus SCM for 400-gig applications and additional preproduction shipments of Scorpio P-Series switches.

The Zacks Consensus Estimate for 2025 revenues is pegged at $605.57 million, indicating a year-over-year increase of 57.95%.

The Zacks Consensus Estimate for 2025 earnings is pegged at $1.13 per share, which has remained unchanged in the past 30 days. The figure calls for a year-over-year increase of 56.15% over 2024’s estimated figure of 72 cents per share.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

What Should Investors Do With ALAB Stock?

Despite a strong product portfolio, ALAB faces increasing competition in the AI and cloud markets, particularly from larger semiconductor companies that are ramping up their product offerings for AI infrastructure, which is a concern.

The company expects non-GAAP gross margins to decrease due to a product mix shift toward hardware solutions.

ALAB stock is not so cheap, as suggested by the Value Score of F.

In terms of the forward 12-month Price/Sales, ALAB is trading at 37.31X, higher than the sector’s 8.71X.

Price/Sales (F12M)

Image Source: Zacks Investment Research

Astera Labs currently has a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.