The United States is expected to see robust demand for electric power from artificial intelligence (AI)-driven data center growth, widespread adoption of electric vehicles (EV), and an increase in residential demand. In this regard, renewable energy is emerging as an industry-promising long-term gain. Out of several forms of alternative energy, wind energy and solar energy are at the forefront of the global transition toward renewables, a critical theme in combating climate change.

Here, we have selected four utilities with a growing focus on wind and solar energy. These are: The AES Corp. (AES – Free Report) , OGE Energy Corp. (OGE – Free Report) , WEC Energy Group Inc. (WEC – Free Report) , NiSource Inc. (NI – Free Report) and CMS Energy Corp. (CMS – Free Report) .

Record Solar Installations Boost Prospects

The U.S. solar industry has been witnessing a solid installation trend lately. The U.S. Energy Information Administration expects a solid 25 GW of solar generation capacity to come online in 2025.

This will cause the nation’s total solar generation capacity to reach 153 GW in 2025 from 128 GW anticipated for 2024. Such impressive projections are indicative of a bright outlook for U.S. solar stocks.

Wind Energy – A Key Growth Catalyst

Land-based, utility-scale wind turbines provide one of the lowest-priced energy sources available in the market right now. Furthermore, wind energy’s cost competitiveness continues to improve with advances in the science and technology of wind energy.

Apart from being an abundant and inexhaustible resource, wind also provides electricity without burning any fuel or polluting the air. Per the U.S. Department of Energy, wind energy in the country helps avoid 336 million metric tons of carbon dioxide emissions annually, which is equivalent to emissions from 73 million cars.

The demand for wind energy is rising globally. According to a Skyquest report, the global wind energy market size was valued at $87.66 billion in 2023 and is poised to reach $174.67 billion by 2031 from $95.54 billion in 2024, at a CAGR of 9%.

Buy 5 Renewable Energy Stocks

These five renewable stocks have strong long-term potential. These stocks have seen positive earnings estimate revisions in the last 60 days. Each of our picks currently carries a Zacks Rank #2 (Buy). At the same time, these companies pay dividends regularly at an attractive rate. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

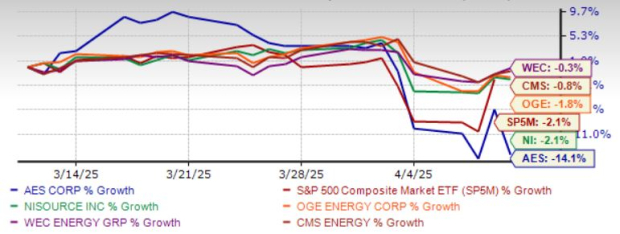

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

The AES Corp.

AES is one of the forerunners in the utility industry’s transition to clean energy by investing in sustainable growth and innovative solutions while delivering superior results. AES continues to invest in clean energy projects. In 2024, AES completed the construction of 3 gigawatts (GW) of wind, solar, gas and energy storage. AES expects to add a total of 3.2 GW of new renewables to its operating portfolio by the end of 2025.

Increased social awareness about renewable energy expansion is likely to offer ESG incentives to AES. Its U.S. renewables business has a 51 GW pipeline. AES has also been expanding its footprint in the liquified natural gas market.

AES has an expected revenue and earnings growth rate of 3.1% and -1.4%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.9% over the last 30 days. AES has a current dividend yield of 6.32%.

OGE Energy Corp.

OGE Energy has been investing steadily to expand its renewable generation assets. The company is focused on reducing its carbon dioxide emissions to 50-52% by 2030. As of Dec. 31, 2024, OGE owned the 120 megawatts (MW) Centennial, 101 MW OU Spirit and 228 MW Crossroads wind farms. It also owns and operates six solar sites across the state of Oklahoma and one in Arkansas, which comes with a cumulative generation capacity of 32.2 MW.

Moreover, OGE offers the Renewable Energy Credit purchase program, the Green Power Wind Rider and the Utility Solar Program, which are rate options that make renewable energy resources available as a voluntary option to all OG&E Oklahoma retail customers. Looking ahead, its subsidiary OG&E aims to continue to deploy more renewable energy sources that do not emit greenhouse gases. Such initiatives should further boost OGE’s renewable energy portfolio.

OGE has an expected revenue and earnings growth rate of 0.8% and 3.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.4% over the last 60 days. OGE has a current dividend yield of 3.88%.

WEC Energy Group Inc.

WEC Energy Group is investing in cost-effective zero-carbon generation like solar and wind. During 2025-2029, WEC plans to invest $28 billion, out of which $9.1 billion will be invested in regulated renewable projects. The idea is to further strengthen WEC’s renewable portfolio.

During 2025-2029, WEC plans to build and own nearly 4.4 GW. This includes solar generation of 2.9 GW, with an investment of $5.5 billion, battery storage of 565 MW, with an investment of $0.9 billion, and wind generation of 900 MW, with an investment of $2.7 billion.

WEC Energy Group has an expected revenue and earnings growth rate of 9.2% and 8.5%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 30 days. WEC has a current dividend yield of 3.42%.

NiSource Inc.

NiSource expects to invest $19.4 billion during 2025-2029 to modernize infrastructure, which will enhance the reliability of its operations. NI continues to add clean assets to its portfolio and retire coal-based units. NI is set to retire its 100% coal-generating sources between 2026 and 2028 and replace the production volumes with reliable and cleaner options at lower costs.

NI aims to reduce greenhouse gas emissions by 90% by 2030 from the 2005 levels. This initiative can help NI lower the cost of operations by focusing on new and advanced assets. New products and services can lead to added revenue streams.

NiSource’s first two solar projects, Dunns Bridge 1 and Indiana Crossroads Solar, came online in July 2023. Constructions on Fairbanka Solar, Gibson Solar and Dunns Bridge 2 Solar Plus Storage are in progress and expected to be in service in 2025. These investments and renewable projects will boost NI’s clean power generation portfolio.

NiSource has expected revenue and earnings growth rates of 11.1% and 6.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 60 days. NI has a current dividend yield of 2.94%.

CMS Energy Corp.

CMS Energy remains one of the primary utility providers in Michigan. CMS plans to invest $20 billion in infrastructure upgrades, repair and clean energy generation during 2025-2029. In November 2024, CMS filed its 20-year renewable energy plan, which includes the addition of nine GW of solar and four GW of wind to its generation portfolio during 2025-2045.

CMS aims to spend $5.2 billion on renewables, including investments in wind, solar and hydroelectric generation resources in the 2025-2029 period. Such strategies should further boost CMS’ renewable energy generation portfolio.

CMS Energy has an expected revenue and earnings growth rate of 7.4% and 7.8%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last 60 days. CMS has a current dividend yield of 3.05%.

Financial Market Newsflash

No financial news published today. Check back later.