C3.ai (AI – Free Report) shares are currently overvalued, as suggested by its Value Score of F.

In terms of the forward 12-month Price/Sales, AI is trading at 6.65X, higher than the sector’s 5.78X.

C3.ai is expensive compared with its industry peers Infosys, Stem and Taboola.com, which currently trade at forward 12-month Price/Sales of 3.73X, 0.27X and 0.46X, respectively.

Price/Sales (F12M)

Image Source: Zacks Investment Research

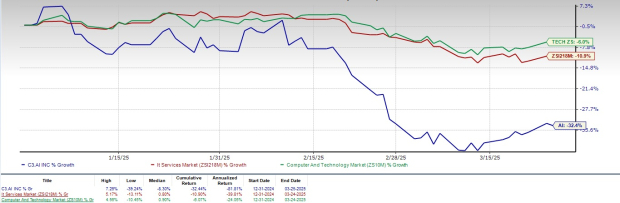

AI shares have lost 32.4% in the year-to-date period compared with the Zacks Computer & Technology sector’s decline of 6% and the Zacks Computers – IT Services industry’s decline of 10.9%. The underperformance can be attributed to macroeconomic uncertainties and stiff competition in the enterprise AI sector.

C3.ai Underperforms Sector, Industry

Image Source: Zacks Investment Research

However, C3.ai is benefiting from an expanding clientele, along with advancements in Enterprise AI and Generative AI offerings.

Can AI maintain its growth trajectory? Let us find out.

AI Push Helps C3.ai to Gain Customers

C3.ai’s expanding clientele has been noteworthy. In the third quarter of fiscal 2025, the company secured 66 agreements, including 50 pilot projects, representing a 72% year-over-year surge. This reflects a notable increase in demand for its Enterprise AI and Generative AI offerings.

Building on this momentum, in March 2025, C3.ai announced an alliance with PwC to drive enterprise-scale AI-powered business transformation across key industries, such as banking, manufacturing and utilities.

The partnership leverages C3.ai’s advanced AI solutions, including C3 AI Reliability, Anti-Money Laundering and Energy Management, combined with PwC’s deep industry expertise to enhance predictive maintenance, combat financial fraud and improve energy efficiency.

C3.ai Expands With Key Partnerships & AI Growth

C3.ai has been one of the prominent AI stocks in recent times, thanks to the strong demand for C3 Generative AI solutions and an expanding partner base. In the third quarter of fiscal 2025, AI finalized 47 agreements through its partner network, marking a 74% year-over-year increase.

Partnerships with major players like Microsoft (MSFT – Free Report) , Amazon’s (AMZN – Free Report) cloud computing platform AWS, and McKinsey QuantumBlack helped accelerate sales cycles, expand global reach and deliver more impactful solutions to clients.

In the third quarter of fiscal 2025, C3.ai and Microsoft closed 28 agreements across nine industries, marking a 460% quarter-over-quarter upsurge. The joint qualified opportunity pipeline skyrocketed more than 244% year over year, with sales cycles shortening by nearly 20% sequentially.

In the same quarter, C3.ai and AWS expanded their partnership to accelerate the adoption of advanced Enterprise AI solutions, emphasizing a strong go-to-market strategy through joint offerings, deeper cloud integration and enhanced AI-driven capabilities for enterprises.

C3.ai’s AI applications became immediately purchasable on Microsoft Azure, AWS and Alphabet’s (GOOGL – Free Report) cloud computing platform, Google Cloud, improving accessibility for enterprises. C3.ai also collaborated closely with Google Cloud to enhance AI deployment for enterprise clients.

AI Provides Solid Top-Line Growth Guidance

C3.ai’s strong adoption of C3 Generative AI solutions and increased demand for its Enterprise AI software has been noteworthy.

For fourth-quarter fiscal 2025, the company expects revenues between $103.6 million and $113.6 million.

For fiscal 2025, C3.ai expects revenues between $383.9 million and $393.9 million.

C3.ai’s Earnings Estimates Show Mixed Trend

The Zacks Consensus Estimate for fourth-quarter fiscal 2025 revenues is pegged at $108.40 million, indicating growth of 25.18% from that reported in the year-ago quarter.

The consensus mark for loss is pegged at 21 cents per share, which has been unchanged over the past 30 days. The figure indicates a year-over-year plunge of 90.91%.

The Zacks Consensus Estimate for fiscal 2025 revenues is pegged at $388.47 million, indicating 29.67% year-over-year growth.

The consensus mark for loss is pegged at 47 cents per share, which has been unchanged over the past 30 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

What Should Investors Do With AI Stock Now?

Despite strong demand for C3 Generative AI solutions and an expanding partner base, C3.ai is suffering from stiff competition in the enterprise AI sector. This intense competition clouds the company’s efforts to gain a stronger foothold in the market.

As a result, C3.ai has made plans to invest aggressively in its offerings to secure market share. However, this strategy is expected to keep margins under pressure in the near term, making the stock risky for investors.

AI is also suffering from macroeconomic uncertainties, which are impacting its development, adoption and integration across industries. Stretched valuation is another concern.

C3.ai currently carries a Zacks Rank #3 (Hold), suggesting that it may be wise to wait for a more favorable entry point in the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.