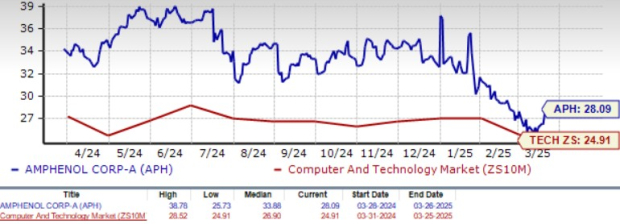

Amphenol (APH – Free Report) shares are overvalued, as suggested by a Value Score of D. APH stock is trading at a significant premium with a forward 12-month Price/Earnings (P/E) of 28.09X compared with the Zacks Computer and Technology sector’s 24.91X.

APH is trading at a premium against its competitors like CommScope (COMM – Free Report) , TE Connectivity (TEL – Free Report) and Sensata Technologies Holding (ST – Free Report) . CommScope, TE Connectivity, and Sensata Technologies Holding’s shares are currently trading at P/E of 6.31X, 17.67X and 8.38X, respectively.

Price/Earnings Ratio (F12M)

Image Source: Zacks Investment Research

Is Amphenol still an attractive stock for investors despite a premium valuation?

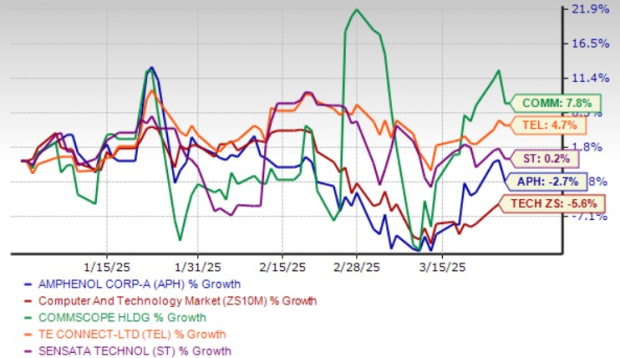

APH shares have declined 2.7% year to date, outperforming the broader sector, which declined 5.6%. Shares of CommScope, TE Connectivity and Sensata Technologies Holding declined 7.8%, 4.7% and 0.2%, respectively, outperforming Amphenol.

APH Stock’s Performance

Image Source: Zacks Investment Research

However, on a trailing 12-month period, APH shares have appreciated 17.2%, underperforming CommScope but outperforming TE Connectivity and Sensata Technologies Holding. While COMM shares surged 329% over the same timeframe, TEL shares inched up 3.1%, but ST fell 25.2%.

Amphenol has been benefiting from higher revenues across the IT datacom, mobile networks, broadband, defense, commercial air and mobile devices automotive end-markets. In the fourth quarter of 2024, Amphenol saw record orders of $5.14 billion, up 58% year over year, resulting in a book-to-bill ratio of 1.16:1. The strong orders were primarily driven by increased demand from data centers, especially due to investments in artificial intelligence by several large customers.

APH Stock Rides on Diversified Business

Amphenol’s diversified business model lowers the volatility of individual end markets and geographies. Its wide array of interconnect and sensor products boosts long-term prospects.

Amphenol’s long-term prospects benefit from strong spending by countries around next-generation defense technologies. Strong demand for jet-liners and next-gen aircraft is bullish for the commercial aerospace segment.

Amphenol plans to expand its high-technology interconnect antenna and sensor offerings, both organically and through complementary acquisitions in the industrial domain. The company’s solutions are critical for both high-speed power and fiber optic interconnect solutions. The growing use of AI and machine learning is driving these technologies, benefiting APH’s long-term prospects in the IT datacom end market.

Acquisitions Boost Amphenol’s Prospects

Acquisitions have helped APH strengthen its product offerings and expand its customer base. The buyouts contributed 8% to 2024 revenues.

In May 2024, it completed the acquisition of CIT, which expanded Amphenol’s footprint across defense, commercial air and industrial end markets. The Lutze acquisition strengthens APH’s broad offering of high-technology interconnect products for industrial markets and expands the range of value-added interconnect products.

The acquisition of CommScope’s Outdoor Wireless Networks and Distributed Antenna Systems businesses expands Amphenol’s footprint in the areas of base station antennas and related interconnect solutions, as well as distributed antenna systems.

APH Offers Positive Q1 Guidance

Amphenol expects first-quarter 2025 earnings between 49 cents and 51 cents per share, indicating growth between 23% and 28% year over year. Revenues are anticipated between $4 billion and $4.10 billion, suggesting growth in the 23-26% range. APH expects first-quarter 2025 sales in the defense market to increase moderately on a sequential basis.

The Zacks Consensus Estimate for first-quarter 2025 earnings is pegged at 52 cents per share, up by a penny over the past 30 days and indicating 30% growth over the year-ago quarter’s reported figure.

The consensus mark for first-quarter 2025 revenues is pegged at $4.19 billion, indicating year-over-year growth of 28.55%.

APH’s earnings beat the Zacks Consensus Estimate in the trailing four quarters, with the average surprise being 8.53%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The Zacks Consensus Estimate for 2025 revenues is pegged at $18.51 billion, indicating year-over-year growth of 21.57%.

The consensus mark for earnings is pegged at $2.34 per share, up 2.6% over the past 30 days and indicates 23.81% growth year over year.

Conclusion

Amphenol benefits from a diversified business model. APH’s strong portfolio of solutions, including high-technology interconnect products, is a key catalyst. Expanding spending on both current and next-generation defense technologies bodes well for the company’s top-line growth.

Amphenol stock currently has a Zacks Rank #2 (Buy) and a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.