You might not realize it, but today (Feb. 14) marks the deadline for what can be described as the most important data release of the first quarter.

Institutional investors with at least $100 million in assets under management (AUM) are required to file Form 13F with the Securities and Exchange Commission (SEC) no later than 45 calendar days following the end of a quarter. A 13F provides a snapshot of which stocks Wall Street’s most prominent money managers purchased and sold in the latest quarter (in this instance, the December-ended quarter).

Image source: Getty Images.

However, not all institutional investors and billionaire asset managers wait until the deadline to file their 13F with the SEC. On Monday, Feb. 10, billionaire David Tepper, who oversees close to $6.5 billion in AUM at Appaloosa, filed his fund’s 13F.

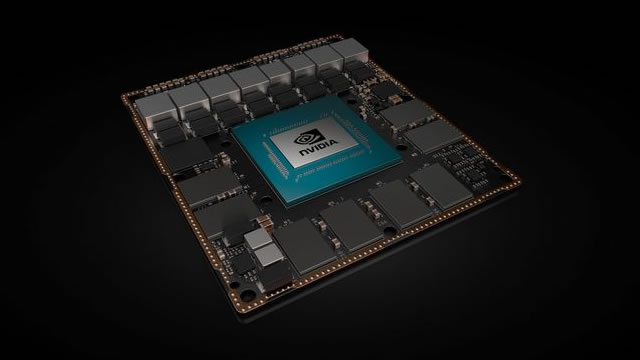

While most investors will likely be enamored with Tepper’s continued buying of cheap China stocks, including JD.com, Alibaba Group, and Baidu, perhaps the biggest eyebrow-raiser of Appaloosa’s 13F is Tepper buying Nvidia (NVDA 3.16%) stock and selling shares of one of its top artificial intelligence (AI) rivals.

David Tepper’s Appaloosa boosts its stake in Nvidia

What makes Appaloosa’s latest 13F so intriguing is that it lays out the purchase of 55,001 shares of Nvidia stock, which increased the fund’s stake by 8.8% from Sept. 30. It’s a reversal of selling Nvidia stock, which Wall Street had witnessed from Tepper throughout the first nine months of 2024.

Tepper’s renewed interest in the face of the AI revolution might have everything to do with Nvidia’s dominant role in AI-accelerated data centers. The company’s famed Hopper (H100) graphics processing unit (GPU) and successor Blackwell GPU architecture are seemingly light years ahead of the competition in terms of computing speed. With split-second decision-making being especially important for AI-driven software and systems, Nvidia’s hardware is the clear top option.

Tepper and his team at Appaloosa might also be impressed with Nvidia’s ability, thus far, to keep customers loyal to its ecosystem of products and services. Nvidia’s CUDA software platform is the toolkit developers are using to get the most out of their Nvidia GPUs, as well as to build large language models. Without CUDA, Nvidia would be nowhere near as successful as it is today.

It doesn’t hurt that most of Wall Street’s most-influential companies are buying Nvidia’s GPUs in bulk, either. Microsoft, Meta Platforms, Amazon, and Alphabet, are just some of Nvidia’s prominent clients.

But this 55,001-share purchase is also a bit curious considering Tepper traditionally focuses on deep-value stocks. Although Nvidia has backed off of its price-to-sales (P/S) ratio peak of more than 42 that was reached last summer, the company’s current P/S ratio of close to 30 is still well above its historic norm and is consistent with bubble territory for previous market-leading businesses.

To add, companies spearheading next-big-thing innovations over the last three decades have a checkered past. Specifically, investors have a habit of overestimating the early adoption and utility of new technologies, which has consistently resulted in an eventual bubble-bursting event. If an AI bubble were to form and burst, no company would be more directly impacted than Nvidia.

History has a flawless track record when it comes to the early ramp up of game-changing innovations, which might spell trouble for Tepper’s investment in Nvidia.

Image source: Getty Images.

Tepper sends 60% of his fund’s stake in Intel to the chopping block

On the other hand, Tepper was a busy bee when it came to reducing Appaloosa’s stakes in a number of high-profile tech stocks during the fourth quarter, including Amazon, Meta Platforms, Taiwan Semiconductor Manufacturing, and Oracle. But the standout sale of the December-ended quarter for Tepper was dumping 1.5 million shares (60% of his fund’s position) of chipmaker Intel (INTC 7.34%).

Whereas Nvidia’s operating expansion has been nothing short of textbook, Intel’s downfall is the stuff nightmares are made of. It was late to pivot to enterprise GPUs and cloud computing, and has seen some of its central processing unit (CPU) market share in personal computers (PCs) and data centers gobbled up by Advanced Micro Devices.

To make matters worse, Intel has been spending big bucks to build out its foundry services from scratch. Though the company still believes it can become the world’s No. 2 foundry by the turn of the decade, the high costs of developing this segment from the ground up have weighed heavily on Intel’s bottom line.

While it’s crystal clear that Intel’s turnaround efforts will take a substantial amount of time, this is the ideal example of a deep-value stock that Tepper would typically be edging into and not aggressively selling.

For instance, even with its tardiness, Intel should be a prime beneficiary of the rise of AI. The company’s Gaudi AI chips offer an attractive price point at a time when Nvidia’s pricing power is through the roof. As AI-GPU scarcity naturally ebbs in the quarters to come, and businesses tire of waiting in extensive backlogs to receive their hardware, Intel should have no trouble selling through its AI-accelerating chips.

It’s also worth noting that President Donald Trump has taken a protectionist approach to domestic AI intellectual property. With a big emphasis on promoting national security and U.S. AI supremacy, Intel should have numerous chances to (pardon the necessary pun) chip away at Nvidia’s monopoly like GPU share and become a key player in next-generation data centers.

Further, there’s the possibility of Intel spinning off its foundry business into a separate entity, which would unencumber its profitable chip segments from heavy losses in the near term. Spinoffs usually make businesses easier to understand, which can unlock value for shareholders.

Lastly, Intel stock is historically cheap, with shares trading at a 9% discount to book value, as of this writing on Feb. 11. This is to say that Tepper showing 60% of his fund’s Intel stake to the door may be a move he eventually regrets.

Financial Market Newsflash

No financial news published today. Check back later.