eBay Inc. (EBAY – Free Report) stock soared 9.86% in the last trading session, reaching an intraday high of $71.52 per share, which also marks its 52-week peak. The stock saw a significant spike after Meta Platforms (META – Free Report) revealed its plans to feature certain eBay listings on Facebook Marketplace.

The key question now is whether investors should capitalize on the momentum. Before offering any investment advice, let’s first take a closer look at the details of the news.

eBay Listings Coming to Facebook Marketplace: META’s Strategy

META has announced its plan to launch a pilot project in Germany, France and the United States, where eBay listings will be displayed on Facebook Marketplace, and transactions will be completed on eBay.

The move follows last November’s European Commission ruling that Facebook Marketplace has disrupted competition among online marketplaces in Europe.

Could This Be a Breakthrough for eBay?

With eBay experiencing stagnation in its business, the integration of its listings into the Facebook Marketplace could provide the boost it desperately needs. Analyzing the third-quarter 2024 earnings transcript, it becomes clear that eBay’s performance reflects challenges in achieving sustained growth.

For instance, eBay reported 133 million active buyers, representing a mere 1% year-over-year increase. Additionally, its gross merchandise volume (GMV) of $18.3 billion grew only 2% despite being positive for the second consecutive quarter. These modest gains highlight eBay’s ongoing struggle to expand its user base significantly or drive substantial growth in overall marketplace transactions.

A closer examination of the results reveals a more nuanced picture. The company’s strategic focus on specific categories, such as luxury fashion and collectibles, resulted in a nearly 5% GMV growth in these segments. However, this growth was not enough to offset flat performance across the rest of the marketplace. This disparity underscores eBay’s challenge: while targeted innovations in certain niches show promise, the platform has yet to translate these successes into broader momentum across its marketplace.

Time to Bet on eBay?

By showcasing select product listings on Facebook Marketplace in three countries, eBay can leverage Facebook’s vast user base to significantly expand its reach and visibility. This increased exposure helps sellers attract more potential buyers, improving their chances of making sales. At the same time, the partnership strengthens eBay’s brand presence by positioning its listings on another widely-used platform. Ultimately, this collaboration drives more traffic and sales back to eBay, creating value for both sellers and the company.

However, investors shouldn’t rush to bet on eBay, which carries a Zacks Rank of #3 (Hold). Although the 10% surge in stock price might be attributed to short-term enthusiasm for the partnership with Facebook Marketplace, this initiative is still in the testing phase and may not yield material benefits immediately. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

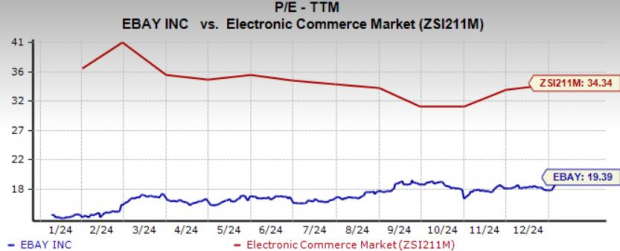

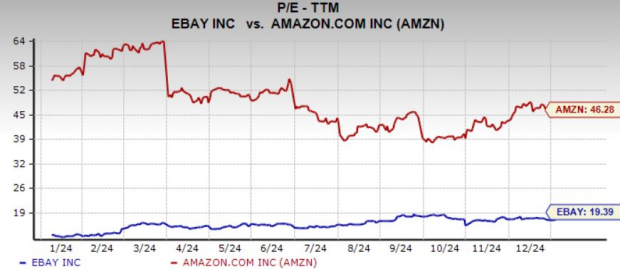

Thus, though eBay appears undervalued, investors should wait for more tangible results before making a move. The stock is currently trading at a trailing 12-month price-to-earnings (P/E) of 19.39x, which trails the industry average of 34.34x and Amazon.com Inc’s (AMZN – Free Report) – another global e-commerce giant – 46.28x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Financial Market Newsflash

No financial news published today. Check back later.