Endeavour Silver Corporation (EXK – Free Report) has entered into an agreement to acquire Compañia Minera Kolpa S.A. for a total consideration of $145 million. With this move, EXK will add the promising Kolpa mine located in Huancavelica Province, Peru, taking its tally of producing mines to three and marking its foray in the country. Kolpa is expected to boost Endeavour Silver’s production profile by approximately 5 million silver equivalent (AgEq) ounces. This move is consistent with the company’s plan to become a senior silver producer.

The transaction is expected to close in the second quarter of 2025, subject to clearance of regulatory approvals and customary closing conditions.

Kolpa to Boost EXK’s Production Profile and Mark Entry in Peru

Minera Kolpa, a silver-focused polymetallic mining company, directly or indirectly holds mining rights to 143 mining concessions and claims covering 25,177 hectares and one beneficiation concession covering 366 hectares. The land package remains underexplored, with only approximately 10% of the claims worked to date, with multiple targets identified for future exploration by Minera Kolpa exploration geologists.

Kolpa has rich deposits of silver, lead, zinc and copper, which are mined using underground mining methods that align well with Endeavour Silver’s technical expertise in underground mining.

Kolpa has been in continuous production for more than 25 years. The operation has undergone numerous throughput expansions. It has a concentrator plant with a current capacity of 1,800 tons per day (tpd), with scope of expansion to 2,500 tpd.

Kolpa produced approximately 5.1 million silver equivalent ounces in 2024. This consists of 2 million ounces of silver, 19,820 tons of lead, 12,554 tons of zinc and 518 tons of copper.

Endeavour Silver is a mid-tier silver producer with two high-grade, underground silver- gold mines in Mexico (Guanacevi and Bolañitos). In 2024, the company produced 7.6 million silver-equivalent ounces.

EXK is developing the Terronera project in Mexico, which is scheduled for wet commissioning in the second quarter of 2025. With Terronera’s projected average annual production of 4 million ounces of silver and 38,000 ounces of gold (or around 7 million silver equivalent ounces), it is set to nearly double Endeavor Silver’s current production. The company has five other projects with solid growth opportunities across Mexico, Chile and USA.

The addition of Kolpa marks a strategic step in Endeavour Silver’s plan to become a senior silver producer. In addition to boosting EXK’s production profile, Kolpa is expected to establish a strategic foothold for the company for future acquisitions in Peru, which is the third-largest silver production country after Mexico and China.

Financing Structure for EXK’s Kolpa Deal

The total consideration comprises $80 million payable in cash and $65 million payable in EXK shares on closing of the transaction. Endeavour Silver will also make $10 million in contingent payments, payable in cash, based on the NI 43-101 resource estimate above 100 million silver equivalent ounces.

Endeavour Silver intends to fund the cash consideration through a combination of cash, net proceeds from a streaming agreement entered into with Versamet Royalties Corporation for copper produced from Kolpa and a bought deal financing of $45 million.

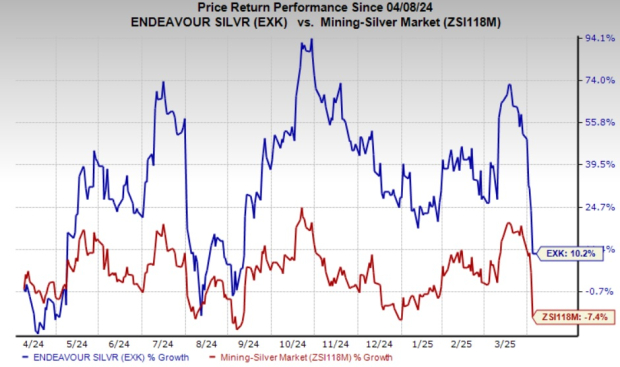

Endeavour Silver Stock’s Price Performance

EXK shares have gained 10.2% over the past year against the industry’s 7.4% decline.

Image Source: Zacks Investment Research

EXK’s Zacks Rank & Stocks to Consider

Endeavour Silver currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the basic materials space are Carpenter Technology Corporation (CRS – Free Report) , Idaho Strategic Resources (IDR – Free Report) and Hawkins (HWKN – Free Report) . Each of these stocks currently carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Carpenter Technology has an average trailing four-quarter earnings surprise of 15.7%. The Zacks Consensus Estimate for CRS’ 2025 earnings is pegged at $6.95 per share, which indicates year-over-year growth of 46.6%. Carpenter Technology shares gained 88.1% in the last year.

Idaho Strategic Resources has an average trailing four-quarter earnings surprise of 77.5%. The Zacks Consensus Estimate for Idaho Strategic’s 2025 earnings is pegged at 78 cents per share, indicating year-over-year growth of 16.4%. IDR shares jumped 66% in the last year.

Hawkins has an average trailing four-quarter earnings surprise of 6.1%. The Zacks Consensus Estimate for Hawkins’ 2025 earnings is pegged at $4.00 per share, implying year-over-year growth of 11.4%. HWKN stock gained 35% in the last year.

Financial Market Newsflash

No financial news published today. Check back later.