Note: The following is an excerpt from this week’s Earnings Trends report. You can access the full report that contains detailed historical actual and estimates for the current and following periods, please click here>>>

Here are the key points:

- The Q1 earnings season will be less about what companies earned in the first quarter of 2025 and more about sizing up the earnings impact of the emerging tariff and macroeconomic backdrop. Pre-announcements and guidance from some of the early reporting companies suggest that most companies may be forced to withdraw or lower their earlier guidance given the tariff-induced uncertainty.

- Guidance is always the most important aspect of any earnings season, but it will be an even more significant part of the Q1 reporting cycle.

- Total 2025 Q1 earnings for the S&P 500 index are expected to be up +5.8% from the same period last year on +3.8% higher revenues, which would follow the +14.1% earnings growth on +5.7% revenue growth in the preceding period.

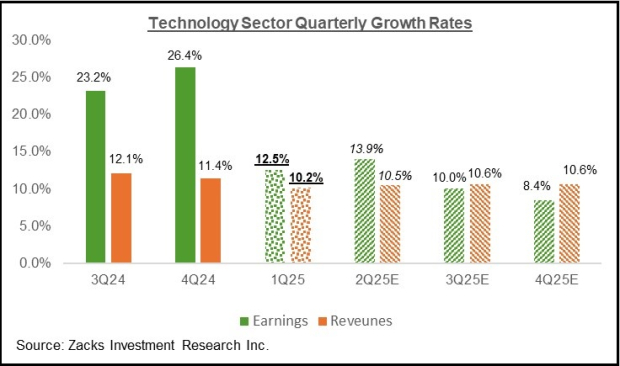

- Concerning year-over-year earnings growth, 8 of the 16 Zacks sectors are expected to enjoy positive earnings growth, with Medical (+33.6% growth), Utilities (+15.0%), Transportation (+8.6%), and Tech (+12.5%) as the major growth drivers.

Earnings Outlook Gets Cloudy as Uncertainty Hits

The guidance headlines from Walmart (WMT – Free Report) and Delta Air Lines (DAL – Free Report) are a sign of things to come as we head into the Q1 earnings season. The magnitude of uncertainty is so high that most management teams that already provide explicit guidance will likely either withdraw the outlook altogether or lower the bound of their guided range.

You would recall that back in January, at the time of its 2024 Q4 earnings release, Delta expected this year to be a new company record. Delta had walked some of the earlier bullishness back in its early March pre-announcement when it noted a decelerating trend in corporate sales; they have now withdrawn the full-year outlook.

Walmart’s lower earnings guidance for the current quarter (fiscal quarter ending in April) reflects ‘price investments’ and an unfavorable merchandise mix, both reflecting the impact of tariffs and consumer spending. We had been seeing this in the revisions trend already, with estimates steadily coming down.

Tech Remains a Growth Driver

The Tech sector has been a significant growth driver in recent quarters, and we saw the same trend at play in 2024 Q4. For Q1, Tech sector earnings are expected to be up +12.5% from the same period last year on +10.2% higher revenues, the 7th quarter in a row of double-digit earnings growth.

This would follow the sector’s +26.4% earnings growth on +11.4% higher revenues in 2024 Q4. As the chart below shows, the sector’s growth trajectory is expected to continue in the coming quarters.

Image Source: Zacks Investment Research

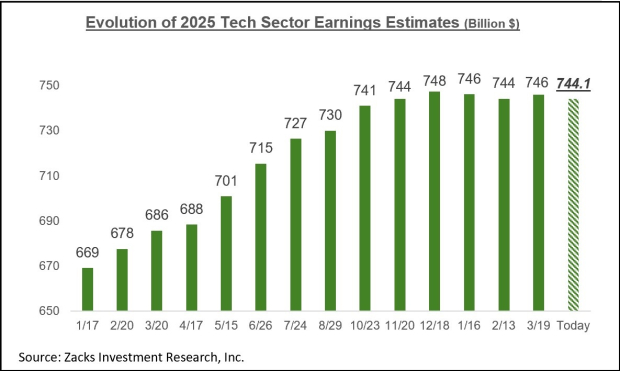

The Tech sector has also been among the few sectors that have steadily enjoyed an improving earnings outlook, with estimates increasing steadily over the past year. However, the more recent data on this count shows a shift in the revisions trend, with estimates for Q1 modestly under pressure since January. This is evident in the chart below, which shows the aggregate 2025 earnings estimates for the sector.

Image Source: Zacks Investment Research

The Earnings Big Picture

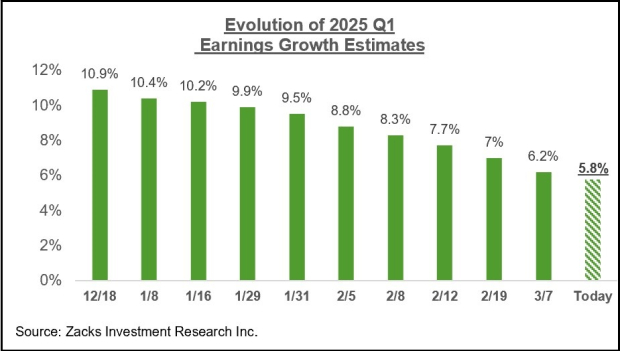

The chart below shows expectations for 2025 Q1 in terms of what was achieved in the preceding four periods and what is currently expected for the next three quarters.

Image Source: Zacks Investment Research

As you can see in the above chart, total S&P 500 earnings for the current period (2025 Q1) are currently expected to be up +5.8% from the same period last year on +3.8% higher revenues. Estimates for the period came down since the quarter got underway, as the chart below shows.

Image Source: Zacks Investment Research

We saw a broad-based negative revisions trend for Q1 and are starting to see a similar trend at play for Q2 and beyond as well.

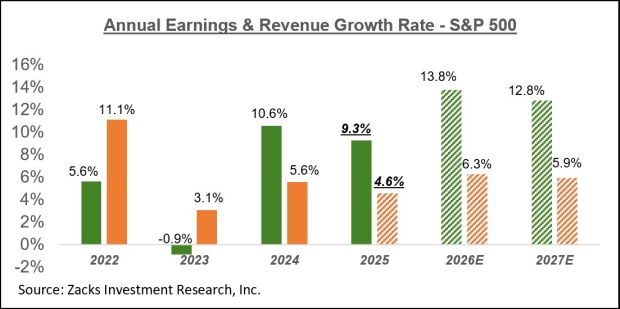

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see, the expectation is for double-digit earnings growth in each of the next two years, with the number of sectors enjoying strong growth notably expanding from the narrow base we have been seeing lately.

However, we should keep in mind that these expectations will most likely be adjusted downward as the effects of slowing U.S. economic growth and tariffs begin to be reflected in diminished corporate profitability. We are already starting to see that downshift in estimates, which will likely accelerate as we go into the heart of the Q1 reporting cycle.

Financial Market Newsflash

No financial news published today. Check back later.