Kohl’s Corporation (KSS – Free Report) is pursuing strategic growth by enhancing customer experience, optimizing inventory and expanding its omnichannel presence. The Sephora partnership continues to drive strong sales, while underpenetrated categories offer new expansion opportunities. However, declining digital sales and macroeconomic challenges raise questions about the retailer’s ability to achieve sustained long-term growth.

Sephora – KSS’ Growth Engine

Kohl’s partnership with Sephora remains key growth driver, with comparable beauty sales rising 13% in fourth-quarter fiscal 2024. Strong demand in Fragrance, Bath & Body, and skincare categories fueled this momentum, while an expanded selection of gift sets boosted sales. Popular brands like Sol de Janeiro, Laneige and Summer Fridays also saw significant growth. Kohl’s is leveraging cross-shopping opportunities to maximize customer engagement. Looking ahead, the company remains optimistic about Sephora’s continued success and long-term growth potential.

Kohl’s Cost-Cutting & Inventory Optimization

Kohl’s continues to streamline inventory management and control expenses, making significant progress in rebuilding proprietary brand inventory during fiscal fourth-quarter. Moving forward, ongoing inventory rebalancing is expected to strengthen operations and drive better performance in fiscal 2025.

The company has also demonstrated strong cost management, reducing SG&A expenses by 4.5% in the quarter through lower spending in stores, marketing and supply chain operations. Kohl’s gross margin improved by 49 basis points (bps) to 32.9%, driven by optimized promotional strategies and lower digital penetration. Looking ahead, Kohl’s expects a further gross margin expansion of 30-50 bps in fiscal 2025, supported by effective inventory control, higher proprietary brand sales and refined promotional strategies. In addition, SG&A expenses are projected to decline by 3.5% to 5%, backed by cost-cutting measures in payroll, supply chain and marketing. Despite a challenging retail environment, Kohl’s strategic expense management underscores its commitment to maintaining profitability and driving long-term growth.

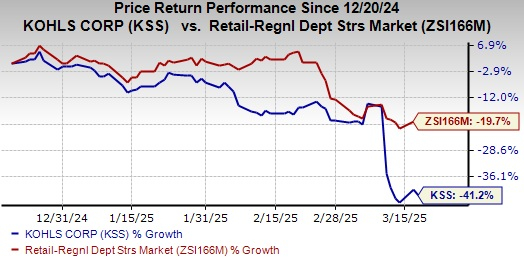

Image Source: Zacks Investment Research

Kohl’s Focuses on Brand Strength and Growth Opportunities

Kohl’s is reinforcing its proprietary brands like Sonoma and Flex, ensuring high-quality and affordable products that appeal to loyal customers. The company is also refining its assortment strategy, optimizing promotions and strengthening national brand partnerships to enhance value. A seamless omnichannel experience remains a priority, with improved store layouts and consistent stock availability for high-demand items.

The retailer sees strong growth potential in categories where it previously lost traction, such as jewelry and fashion accessories. In its last earnings call, management highlighted that it is seeing positive results from its renewed investment in jewelry, with strong sales in fashion and bridge jewelry, as well as fashion accessories and impulse purchases.

Kohl’s is also working to build a stronger presence in underpenetrated markets, focusing on home decor, impulse buys and beauty through its successful Sephora partnership. By refining its product mix and expanding key categories, Kohl’s aims to drive long-term sales and profitability while staying competitive in the evolving retail landscape.

Digital Sales Decline Poses a Challenge for KSS

Despite these positive developments, Kohl’s is struggling with digital sales, which fell 13.4% in fourth-quarter fiscal 2024 and 8.7% for the full year. The decline was primarily driven by weakness in the home category, particularly Legacy Home, which has a higher penetration in online sales. In addition, digital conversion faced headwinds due to an online inventory suppression issue, impacting product availability and customer experience. This underperformance highlights the need for stronger digital execution, as maintaining e-commerce momentum is critical in today’s competitive retail landscape.

KSS’ Road Ahead Looks Tough

As Kohl’s enters 2025, its guidance reflects both the time required for strategic adjustments and ongoing macroeconomic uncertainty. The company projects net sales to decline between 5% and 7%, with comparable sales expected to drop 4% to 6% year over year in fiscal 2025. Management anticipates fiscal 2025 earnings per share to be between 10 and 60 cents, reflecting a year-over-year decline. This disappointing outlook highlights the hurdles Kohl’s faces in stabilizing revenue and driving growth in an evolving retail landscape. Furthermore, the company has made the decision to reduce its dividend rate, which signals an anticipated continued financial strain.

Can Kohl’s Turn Things Around?

Kohl’s has implemented strategic initiatives to drive growth, but it faces challenges. While the Sephora partnership, cost-cutting measures and expansion in key categories show promise, the company must address declining digital sales and macroeconomic pressures. With a disappointing fiscal 2025 outlook, Kohl’s success will depend on its ability to adapt to shifting consumer preferences and strengthen its digital presence while maintaining operational efficiency. At present, KSS carries a Zacks Rank #3 (Hold).

The company’s shares have slumped 41.2% in the past three months compared with the industry’s decline of 19.7%.

Stocks Looking Red Hot

Nordstrom, Inc. (JWN – Free Report) currently sports a Zacks Rank of 1 (Strong Buy). JWN has a trailing four-quarter negative earnings surprise of 26.1%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for JWN’s fiscal 2026 sales indicates a rise of 1.9% from the year-ago period’s levels.

Deckers (DECK – Free Report) , a footwear and accessories dealer, currently has a Zacks Rank #2 (Buy). DECK delivered an average earnings surprise of 36.8% in the trailing four quarters.

The Zacks Consensus Estimate for Deckers’ current financial-year sales indicates growth of 15.6% from the year-ago figure.

Urban Outfitters (URBN – Free Report) , a fashion lifestyle specialty retailer, currently carries a Zacks Rank of 2. URBN delivered an average earnings surprise of 28.4% in the trailing four quarters.

The consensus estimate for Urban Outfitters’ current financial-year sales indicates growth of 6% from the year-ago figure.

Financial Market Newsflash

No financial news published today. Check back later.