NVIDIA (NVDA – Free Report) has been at the forefront of the artificial intelligence (AI) revolution, with its GPUs powering everything from generative AI to autonomous vehicles. Investors have been bullish on the stock, and the company’s aggressive stock buyback strategy is another factor boosting confidence. With a record-breaking fourth-quarter fiscal 2025 earnings report and a $8.1 billion return to shareholders in the form of share repurchases and cash dividends, NVIDIA remains a top-tier investment opportunity.

NVIDIA’s Buyback Strategy: A Vote of Confidence

The S&P Dow Jones Indices data showed that the S&P 500 as a whole saw a record-setting $942.5 billion in buybacks in 2024, an 18.5% increase from 2023. NVIDIA ranked among the top companies along with Apple Inc. (AAPL – Free Report) and Alphabet Inc. (GOOG – Free Report) , which are strongly committed to returning capital back to shareholders.

This move signals strong confidence in the company’s future earnings growth and underscores management’s belief that NVDA shares are currently undervalued. Notably, NVDA is trading at a trailing 12-month price to earnings (P/E) of 41.44x, surpassing the broader industry average of 49.94x.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Buybacks serve to reduce the number of outstanding shares, thus enhancing earnings per share (EPS). This is particularly valuable for NVIDIA, whose EPS for the fourth quarter of fiscal 2025 came in at 89 cents, surpassing the Zacks Consensus Estimate of 84 cents. With demand for AI computing on the rise and NVIDIA’s dominant position in the GPU market, the repurchase program could provide further support to the stock price.

Explosive Growth in AI and Data Centers

NVIDIA’s fourth-quarter fiscal 2025 earnings report revealed a staggering 78% year-over-year revenue growth, reaching $39.3 billion, also surpassing the Zacks Consensus Estimate of $37.7 billion. A significant portion of this came from its data center business, which saw revenue soar to $35.6 billion, driven by demand for its Blackwell GPU architecture. NVIDIA’s AI accelerators remain unmatched, and with the adoption of AI models like OpenAI’s GPT, Meta’s Andromeda, and DeepSeek-R1, the need for high-performance computing is only expected to rise.

NVIDIA highlighted that AI-driven workloads are scaling exponentially, with inference compute demands up to 100 times greater than traditional training. This presents a significant market opportunity as major cloud providers and enterprises continue to invest heavily in AI infrastructure.

The Road Ahead: Blackwell, Buybacks, and Market Domination

NVIDIA’s ability to innovate and scale production remains critical. The launch of the Blackwell Ultra GPUs and future AI-focused architectures, such as Vera Rubin, will further solidify its position in the AI landscape. Additionally, NVIDIA is playing a key role in transforming data centers into AI factories, a trend that will likely drive sustained revenue growth.

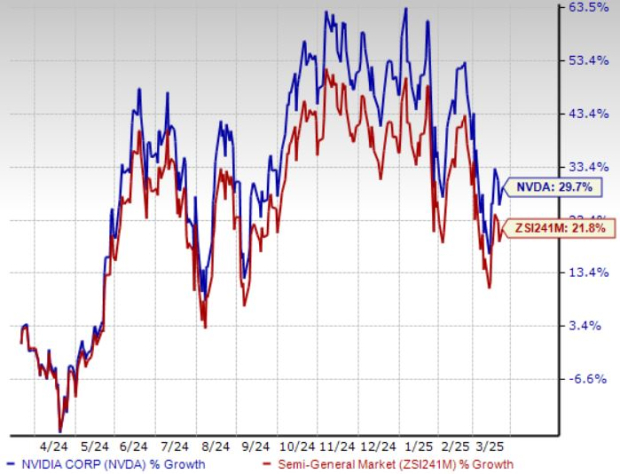

The company’s ongoing share repurchase program suggests that management sees continued upside in its stock, which surged 29.7% over the past year, surpassing the 21.8% improvement of the composite stocks belonging to the industry.

One-Year Price Chart

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

If NVIDIA continues its aggressive buybacks alongside its AI-driven revenue explosion, investors could see significant appreciation in the stock price.

Last Thoughts

For long-term investors, NVIDIA presents a compelling opportunity. The combination of explosive AI demand, record-breaking revenue, and a strong buyback program makes NVDA a dominant force in the technology space. With its relative valuation remaining in favor, along with its robust financials and strategic capital allocation, NVIDIA, which currently carries a Zacks Rank #2 (Buy), will possibly remain as one of the best investment opportunities in the stock market today. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.