Here’s our initial take on Nvidia‘s (NVDA 3.67%) fourth-quarter results.

Key Metrics

| Metric | Q4 2024 | Q4 2025 | Change | vs. Expectations |

|---|---|---|---|---|

| Revenue | $22.1 billion | $39.3 billion | +78% | Beat |

| Earnings per share | $0.49 | $0.89 | +82% | Beat |

| Data center revenue | $18.4 billion | $35.6 billion | +93% | Beat |

| Gross margin | 76% | 73% | -300 bp | n/a |

Nvidia’s AI Business Sees Continued “Amazing” Demand

Nvidia’s results for the fourth quarter of fiscal 2025 provided a dose of optimism during what has been a volatile few weeks for AI bulls, reporting blockbuster revenue and earnings-per-share growth that topped sky-high analyst expectations.

Revenue from data centers accounted for 90% of Nvidia’s total, with AI-related demand more than offsetting setbacks in other parts of the business. Networking revenue fell 9% year over year, which the company said should be a temporary hiccup as it transitions to new products. Sales of gaming chips also fell 11% year over year.

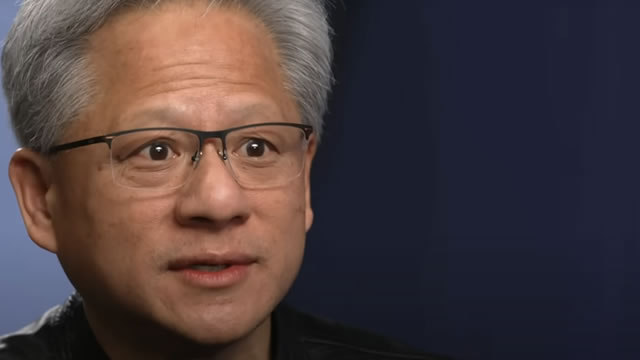

CEO Jensen Huang said demand for Nvidia’s Blackwell chip, its latest chip for powering AI servers, “is amazing” and predicted more to come. “AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries,” Huang said.

With demand comes pricing power. Costs related to Blackwell ate into margins, but Nvidia was still able to post a gross margin of 73% in the quarter, generating $24 billion in operating income on its $39.3 billion in revenue.

Nvidia said inventory at the end of the quarter totaled $10.1 billion, up from $7.7 billion in the prior period. Typically, rising inventories can be viewed as a warning sign. But in Nvidia’s case, it could simply be that the company is stocking up chips to meet the demand for its top-end products.

Immediate Market Reaction

In recent quarters, Nvidia shares have made dramatic moves post-earnings. But the response this time around was more muted. Nvidia shares were down slightly in after-market trading heading into the company’s call with analysts, recovering most of the 3% they lost immediately after the release of earnings.

What to Watch

Some of that subdued response was likely due to Nvidia’s outlook for the quarter to come. Nvidia is anticipating more growth but perhaps not at the levels analysts had expected.

The company forecasted first-quarter sales of $43 billion, plus or minus 2%, and GAAP gross margins of 70.6%, plus or minus 50 basis points. The lower ends of both ranges are below consensus estimates.

Investors will be listening closely on the call for further commentary from Huang about Nvidia’s long-term demand forecast, inventories, and thoughts on what China’s DeepSeek and other new AI models might mean for the future of AI. The company is also likely to try to reassure investors who have been worried that Blackwell might be limited by supply chain issues.

Helpful Resources

- Full earnings report

- Investor relations page

Financial Market Newsflash

No financial news published today. Check back later.