Pinterest (PINS 0.87%), the image-sharing social media platform, announced its earnings for Q4 2024 on February 6, 2025. The company reached an important milestone by recording its first billion-dollar quarter, with revenue reaching $1.154 billion, up 18% from the previous year. This result surpassed analyst expectations of $1.139 billion and even exceeded the higher end of management’s own guidance of $1.125 to $1.145 billion. However, EPS for the quarter came in at $0.56, missing the analyst estimate of $0.64 by 12.5%. Despite the revenue achievement, this earnings miss highlighted ongoing profitability challenges. Overall, the quarter showcased robust user growth but was marred by slower-than-expected EPS growth.

| Metric | Q4 2024 | Q4 Estimate | Q4 2023 | Y/Y Change |

|---|---|---|---|---|

| EPS (Non-GAAP diluted) | $0.56 | $0.64 | $0.53 | +5.7% |

| Revenue | $1,154 million | $1,139 million | $981 million | +18% |

| Adjusted EBITDA | $471 million | – | $369 million | +28% |

| Global Monthly Active Users | 553 million | – | 498 million | +11% |

Source: Analyst estimates provided by FactSet. Management expectations based on management’s guidance, as provided in 2024-11-07 earnings report.

Pinterest’s Business Overview

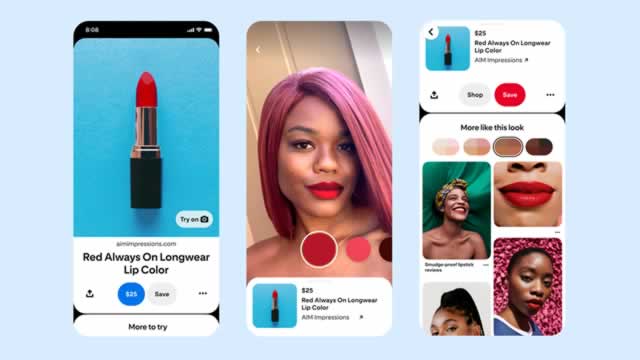

Pinterest, a popular platform that allows users to discover and save creative ideas, has become a significant player in the social media landscape. Its business model revolves around increasing user engagement and monetizing this through advertising. The platform offers an inspirational journey from browsing to purchase, making it appealing to advertisers. Currently, Pinterest is focusing on expanding its user base, particularly in international markets, and enhancing its ad offerings.

Key success factors for Pinterest include its ability to engage users and provide them with relevant, seamlessly integrated advertising. The company is investing in AI and technology to improve its ad auction system and tailor recommendations, aiming to increase both the number of advertisers and the average revenue per user.

Quarter in Review

During Q4 2024, Pinterest recorded an impressive 18% increase in revenue year-over-year, reaching $1.154 billion. This growth was driven by increased international user engagement and a successful monetization strategy. Notably, Global MAUs surged to 553 million, reflecting an 11% increase, with a significant 15% jump in Rest of World (ROW) markets. Adjusted EBITDA, which reflects earnings before interest, taxes, depreciation, and amortization, rose by 28% to $471 million, showcasing strong operational performance.

Despite these positive results, Pinterest’s EPS fell short at $0.56, missing the $0.64 estimate. The deviation is attributed to high operating expenses, notably in share-based compensation. While U.S. and Canada continue to deliver higher Average Revenue Per User (ARPU) at $9.00, the ROW markets lag at $0.19, highlighting disparities in regional monetization.

Pinterest achieved improved advertiser engagement that boosted conversion rates. However, regional ARPU disparities present a challenge, reflecting the need for a more effective monetization strategy in emerging markets. While ad formats are diversified, global advertiser relationships remain crucial to future revenue streams.

Looking Ahead

For Q1 2025, Pinterest projects revenue between $837 million and $852 million, aiming for 13-15% growth. Adjusted EBITDA is forecasted to be $155 million to $170 million. Management’s cautious yet optimistic outlook reflects expectations of revenue growth, supported by expanding penetration in under-monetized international markets.

Investors should focus on Pinterest’s monetization strategies and expense management. The quarter presents an opportunity to refine international revenue generation, aligning advertising growth with increasing MAU figures globally. Management remains committed to building upon its technological capabilities, which will be essential in enhancing user and advertiser experiences.

Financial Market Newsflash

No financial news published today. Check back later.