Chipmaker Nvidia (NVDA -3.09%) will report financial results for the fourth quarter of fiscal 2025 (which ended in January 2025) after the market closes on Wednesday, Feb. 26. Earnings events can introduce a great deal of volatility. Options prices currently imply an 8% move in the stock (up or down) following the quarterly report.

Despite recent disruptions from Chinese start-up DeepSeek, Wall Street remains bullish on Nvidia. Among the 68 analysts who follow the company, the consensus rating is “buy,” and the median target price is $175 per share, according to The Wall Street Journal. That implies 34% upside from its current share price of $131.

Here’s what investors should know.

The investment thesis for Nvidia

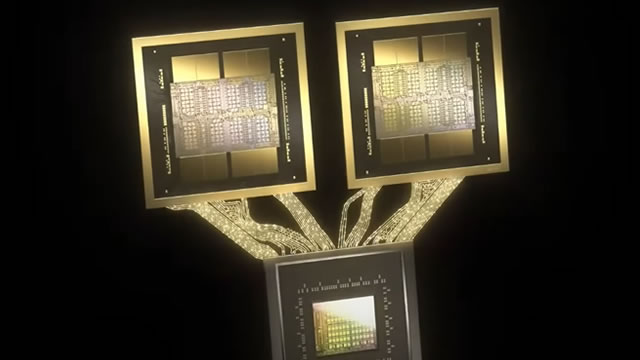

Nvidia’s graphics processing units (GPUs) are the gold standard in accelerating complex data center workloads like training large language models and running artificial intelligence (AI) applications. Forrester Research analysts last year commented, “Nvidia sets the pace for AI infrastructure worldwide. Without Nvidia’s GPUs, modern AI wouldn’t be possible.”

Importantly, Nvidia supplements its GPUs with adjacent data center hardware, including central processing units (CPUs), interconnects, and networking equipment. In fact, the company has a leadership position in networking gear used for generative AI. That vertically integrated business model affords Nvidia an important advantage. The company can build entire AI systems for customers, and those systems generally offer the lowest total cost of ownership.

Nvidia also has opportunities beyond the data center in autonomous driving and autonomous robots. That segment is currently a small fraction of total sales, but CEO Jensen Huang says autonomous-driving revenue will achieve a $5 billion run rate in fiscal 2026, which ends in January 2026. That is nearly triple the revenue run rate from the third quarter of fiscal 2025.

Here is the bottom line: Nvidia is the foundation of the AI revolution, and that burgeoning market opportunity extends well beyond generative AI into autonomous robots and self-driving cars. Grand View Research says spending on AI hardware, software, and services will increase at 36% annually through 2030. Nvidia has a good shot at matching that growth rate.

Image source: Getty Images.

What Wall Street expects from Nvidia in Q4

In fiscal 2025’s Q4, Wall Street expects Nvidia’s revenue to grow 72% to $38 billion, while non-GAAP earnings increase 75% to $0.91 per diluted share. Importantly, the stock will not necessarily rise after an earnings beat. Forward guidance is equally important.

On one hand, several hyperscale cloud companies discussed compute-capacity constraints during their recent earnings calls and outlined plans to invest heavily in AI infrastructure in 2025 to resolve the issue. That list includes Alphabet, Amazon, Meta Platforms, and Microsoft. Greater spending from those companies is a tailwind for Nvidia that could lead to strong guidance.

On the other hand, the U.S. government for several years has progressively tightened export restrictions on semiconductor companies. Those restrictions prevent Nvidia from selling its most powerful GPUs to China, among other countries, but also limit exports to about 120 countries. That headwind could lead to weak guidance.

Importantly, Morgan Stanley analysts led by Joseph Moore recently reiterated Nvidia as their top pick in the semiconductor industry. But they also wrote, “We aren’t seeing the quarter as a major positive catalyst, but we remain convinced once we get past export controls there will be positive momentum into [the second half].”

Should investors buy Nvidia stock before Feb. 26?

Investors should never make decisions based solely on short-term catalysts. But the long-term investment thesis for Nvidia is solid, and Wall Street forecasts adjusted earnings will increase at 51% annually through fiscal 2026, which ends in January 2026. That consensus makes the current valuation of 50 times adjusted earnings look cheap.

At that price, prospective investors should feel confident buying a small position in Nvidia today, provided they have a time horizon of at least three years. However, as I mentioned earlier, earnings events can cause share-price volatility. For that reason, investors planning to buy Nvidia stock should purchase a few shares before earnings and a few shares after earnings.

Financial Market Newsflash

No financial news published today. Check back later.