Sterling Infrastructure (STRL – Free Report) and Granite Construction (GVA – Free Report) are prominent mid-cap construction companies in the United States specializing in large-scale infrastructure, transportation and water-related projects. Both firms have seen tailwinds from rising federal and state infrastructure investments, especially with the momentum generated by the Infrastructure Investment and Jobs Act (IIJA).

As the United States focuses on upgrading aging transportation systems and advancing sustainable infrastructure, these two stocks have become attractive options for investors seeking long-term growth opportunities. But with ongoing economic uncertainty, inflationary pressures and trade-related challenges, is now the right time to invest? Let us delve into their fundamentals, growth potential and key risks.

The Case for Sterling

Sterling has carved out a distinct niche by focusing on high-margin, lower-risk infrastructure projects through its three business segments — E-Infrastructure, Transportation and Building Solutions. The E-Infrastructure segment, which supports data centers and e-commerce logistic hubs, has seen explosive growth, helping STRL diversify away from cyclical public-sector spending. Sterling has consistently posted robust earnings growth and maintained double-digit revenue increases year over year, underpinned by operational efficiency and a disciplined approach to project selection.

Sterling closed 2024 on a high note, delivering adjusted EPS growth of 37% and a 7% increase in revenues. Sterling’s E-Infrastructure segment, making up 44% of 2024 revenues, remains its top performer, driven by large-scale mission-critical projects. Data centers, in particular, have been the primary growth driver, contributing to a 27% increase in E-Infrastructure backlog in 2024. The company’s expertise in delivering projects ahead of schedule and its ability to secure multi-phase contracts has ensured continued strong demand.

Sterling’s focus on high-margin transportation solutions has improved profitability despite flat revenues in the fourth quarter due to reduced low-margin work in Texas. STRL secured several major projects in strategic markets like the Rocky Mountain region and Arizona, leading to a 24% rise in 2024 transportation revenues, representing 37% of total revenues. While IIJA-related spending has somewhat leveled off, the company has built a transportation backlog covering more than two years of work, ensuring strong growth visibility. Continued bidding momentum and project wins are expected in 2025, especially in its core markets.

With a $1.69-billion backlog and $138 million in unsigned awards as of the end of 2024, plus significant future-phase work not yet booked, STRL has strong revenue visibility and a stable foundation for growth.

Sterling’s 2025 guidance underscores its bullish outlook. Revenues are projected between $2 billion and $2.15 billion, indicating up to 10% pro-forma growth. The gross margin is expected to rise to 21-22%, highlighting the company’s improving project mix. Most notably, adjusted EBITDA is forecasted between $395 million and $420 million, suggesting 18% growth at the midpoint versus the $370 million reported in 2024, with adjusted EPS climbing to $7.90-$8.40.

The Case for GVA

Granite’s transformation into a vertically integrated construction and materials company was the central driver behind its 2024 success. The company’s 2024 revenues reached $4 billion, a 14% increase over the prior year, while adjusted EBITDA jumped 44% to $402 million. These results were driven by strategic discipline, improved project execution and strong market fundamentals — particularly in the Construction and Materials segments. The reorganization initiated earlier in the year, which aligned leadership and operations across business lines, played a critical role in elevating efficiency and profitability.

GVA’s strategic refocus, centered around home markets, disciplined project bidding and operating efficiencies, has started to bear fruit. The company also benefited from a historically strong market for publicly funded infrastructure bolstered by the IIJA and state-level transportation budgets, especially in California.

The construction market remains robust, with 75% of Granite’s construction work funded by public agencies. These projects, supported by SB-1 gas tax revenues and federal infrastructure programs, are expected to provide a steady pipeline of opportunities through at least 2026. On the Materials side, the company made key investments in plant modernization, reserve expansion (up 20% to 1.6 billion tons) and automation. Strategic M&A remains a priority, with plans to complete two to three deals annually.

GVA continues to perform well but faces challenges with project delays and execution timing. Delayed construction awards have impacted revenue recognition and led to a sequential decline in committed and awarded projects in the fourth quarter. However, a rebound is expected in 2025 as postponed projects move forward and new contracts are secured.

Granite issued robust guidance for 2025, targeting revenues of $4.2-$4.4 billion, driven by 6-8% organic growth and a full year of contributions from recent acquisitions like Dickerson & Bowen. The company expects the adjusted EBITDA margin to improve to 11-12%, implying a 10-20% increase from that reported in 2024. This margin improvement will come from continued execution on higher-margin construction projects, and sustained pricing strength and efficiency in the Materials segment. The operating cash flow is projected to reach 9% of revenues, already hitting the lower bound of Granite’s 2027 goal.

Stock Performance & Valuation

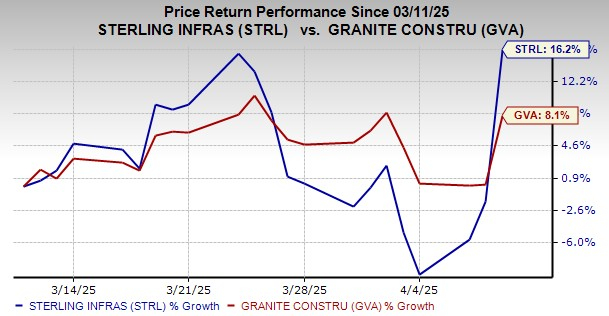

GVA (down 11.5%) has performed better than STRL (down 20.1%) so far in 2025. Yet, over the past month, STRL has gained 16.2%, more than GVA’s 8.1% rally.

Image Source: Zacks Investment Research

Sterling is trading at a forward 12-month price-to-earnings (P/E) ratio of 15.79X, above its median of 11.25X over the last five years. Granite’s forward earnings multiple sits at 13.16X, almost at the same level as its last five years’ median of 13.07X. The STRL stock appears expensive when compared with the Construction sector average of 14.61X. Still, both STRL and GVA stocks have a Value Score of B.

Image Source: Zacks Investment Research

Comparing EPS Projections: Sterling & Granite

The Zacks Consensus Estimate for STRL’s 2025 EPS suggests 34.6% growth, while the 2026 estimate indicates a year-over-year increase of 14.1%. The 2025 and 2026 EPS estimates have trended upward over the past 60 days.

For STRL Stock

Image Source: Zacks Investment Research

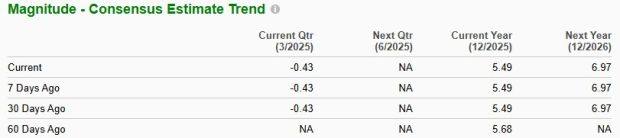

The Zacks Consensus Estimate for GVA’s 2025 and 2026 bottom line implies year-over-year improvements of 13.9% and 27%, respectively. Granite’s EPS estimates have trended downward for 2025 over the past 60 days.

For GVA Stock

Image Source: Zacks Investment Research

Conclusion

Sterling stands out as the stronger buy than Granite, which currently has a Zacks Rank #4 (Sell). While both firms are benefiting from favorable infrastructure spending trends, STRL’s differentiated business model, earnings momentum and superior growth visibility give it a distinct edge. Sterling’s focused strategy in high-margin, lower-risk segments, particularly its booming E-Infrastructure business tied to data centers and logistics, has driven consistent double-digit revenue and earnings growth.

In contrast, although Granite has delivered solid 2024 results, execution challenges and project delays have weighed on near-term momentum. More importantly, downward-trending EPS estimates indicate weakening analyst confidence.

With upward EPS revisions, a robust backlog and strong execution in growth-critical sectors, STRL, currently sporting a Zacks Rank #1 (Strong Buy), presents a compelling opportunity for investors seeking exposure to infrastructure with higher earnings visibility and stronger momentum than GVA.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Financial Market Newsflash

No financial news published today. Check back later.