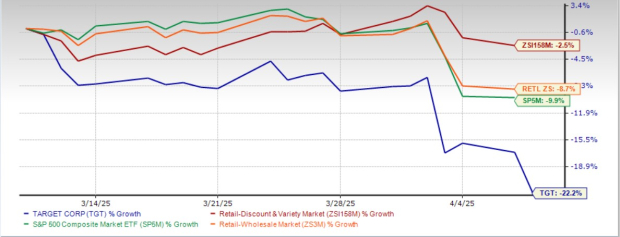

Target Corporation (TGT – Free Report) touched a new 52-week low of $87.35 during yesterday’s trading session before closing briefly higher at $88.76. The stock is now down 22.2% in the past month, prompting investors to reassess their position. As a well-established player in the retail sector, Target is known for its strong market presence and customer-centric approach. However, broader market dynamics, such as tariff concerns and company-specific challenges, might have hurt the stock.

Target has underperformed the Retail–Discount Stores industry and the S&P 500 Index, which recorded respective declines of 2.5% and 9.9% during the same period. The stock also lagged the Retail-Wholesale sector, which fell 8.7%.

Target has even underperformed its peers, such as Dollar General Corporation (DG – Free Report) , Dollar Tree, Inc. (DLTR – Free Report) and Costco Wholesale Corporation (COST – Free Report) . While shares of Dollar General and Dollar Tree have risen 5.9% and 3.3% in the past month, Costco has declined 2.4%.

TGT Stock Past-Month Performance

Image Source: Zacks Investment Research

What’s Hurting TGT Stock?

Target issued a cautious first-quarter fiscal 2025 view. The Minneapolis, MN-based retailer anticipates significant year-over-year profit pressure in the first quarter compared to the rest of the year owing to ongoing consumer uncertainty, a slight decline in February net sales, tariff concerns and the expected timing of certain expenses throughout the fiscal year.

While the company saw record Valentine’s Day sales in February, overall performance for the month was muted. Unseasonably cold weather across the United States weighed on apparel sales, and weakening consumer confidence led to softer demand in discretionary categories.

This remains a core vulnerability for Target, which derives a significant portion of its revenues from discretionary segments such as home goods, hard lines and apparel. These categories are inherently volatile and susceptible to external shocks.

Compounding the uncertainty are persistent risks tied to U.S.-China tariff dynamics. Although Target has made progress in diversifying its sourcing away from China, further tariff escalations could pressure margins by increasing input costs and forcing price adjustments in product lines.

Target’s guidance for fiscal 2025 remains measured. The company expects net sales to grow by approximately 1%, with comparable sales remaining flat. While a modest improvement in the operating margin is anticipated, projected adjusted earnings of $8.80-$9.80 per share suggest only limited upside from the prior year’s $8.86, reinforcing the conservative tone of management’s outlook.

Consensus Estimates for Target Trend Lower

Reflecting a cautious sentiment around Target, the Zacks Consensus Estimate for earnings per share has seen downward revisions. Over the past 60 days, the consensus estimate has declined by 14 cents to $9.18 for the current fiscal and 20 cents to $9.92 for the next fiscal.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Image Source: Zacks Investment Research

Here’s How Target is Repositioning Itself

Target is leveraging its strong brand presence, diverse product portfolio and expanding e-commerce capabilities, alongside a growing store footprint, to solidify its market position and drive sustainable growth. By prioritizing innovation and integrating AI technology, the company is laying a solid foundation for long-term success. Target has outlined a comprehensive strategy to generate more than $15 billion in revenue growth by fiscal 2030.

Seamlessly blending physical stores with a robust digital platform, Target has enhanced the customer shopping experience. The company plans to open more than 20 new stores and remodel several existing locations in fiscal 2025. Its focus on same-day delivery, curbside pickup and personalized online services has bolstered its competitive edge. Same-day services powered by Target Circle 360 grew more than 25% during the final quarter of fiscal 2024. Target Circle membership grew by 13 million new members in 2024.

Target’s multi-category assortment of owned and popular national brands cements its status as a one-stop shopping destination. The retailer has adeptly navigated evolving consumer preferences by expanding its offerings across both discretionary and essential categories. Innovations in high-demand segments underscore TGT’s proactive approach to addressing customer needs, while its balanced product mix continues to attract a broad customer base. Target’s $31 billion private label portfolio is a competitive advantage.

Target’s third-party marketplace, Target Plus, surpassed $1 billion in gross merchandise volume (GMV) in fiscal 2024. The company projects this platform to generate $5 billion in GMV within the next five years, significantly broadening its product assortment. Target’s advertising business, Roundel, generated nearly $2 billion in fiscal 2024 and is expected to double in size within five years.

To boost efficiency, Target is modernizing inventory management with AI-driven solutions that optimize stock availability and delivery speed. The company is also introducing new package delivery solutions that leverage existing supply-chain assets and its Shipt service, ensuring faster and more reliable order fulfillment. Target remains committed to innovation and customer satisfaction, striving to deliver unique shopping experiences while maintaining value. The company plans to invest $4 billion to $5 billion in store remodels, supply-chain expansion and digital transformation in fiscal 2025.

Unlocking Target’s Valuation

Target is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 9.52X, which positions it at a discount compared to the industry’s average of 29.43X. The stock is also trading below its median P/E level of 14.82, observed over the past year.

Target is trading at a discount to Dollar General (with a forward 12-month P/E ratio of 15.52), Dollar Tree (13.06) and Costco (47.77).

Although Target stock is currently trading at a discount compared to its industry peers, this valuation disparity might not be as favorable as it seems. The lower price could be indicative of underlying issues rather than representing a clear investment opportunity.

Image Source: Zacks Investment Research

How to Play TGT Stock?

Given the current backdrop, Target’s stock appears to reflect more than just a temporary market dip. While the company’s long-term strategy is ambitious and focused on innovation, digital expansion and customer engagement, cautious guidance, downward earnings estimate revisions and macroeconomic headwinds cannot be overlooked. For existing shareholders, patience and a long-term view may be necessary, but new investors might want to wait for clear signs of stabilization before initiating a position. TGT currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Financial Market Newsflash

No financial news published today. Check back later.