Terreno Realty Corporation (TRNO – Free Report) recently announced the completion of the redevelopment of its 2.8-acre improved land parcel in Rancho Dominguez, CA. This property has been fully leased on a short-term basis to a trucking and transloading provider for 18 months.

The redeveloped property is located adjacent to two of Terreno Realty’s improved land parcels on S. Maple Avenue and between Los Angeles International Airport and the Ports of Los Angeles and Long Beach.

The redevelopment was completed at a cost of approximately $28.3 million and boasts a stabilized cap rate of approximately 2.3%.

TRNO: In a Nutshell

With a solid operating platform, a healthy balance sheet position and strategic expansion moves, TRNO seems well-positioned to capitalize on long-term growth opportunities amid favorable industry fundamentals. However, the elevated supply of industrial real estate and broader market issues are key concerns.

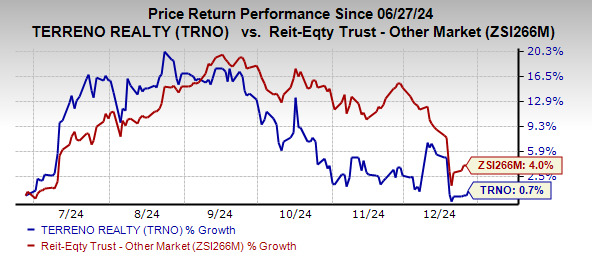

Shares of this Zacks Rank #3 (Hold) company have increased 0.7% in the past six months compared with the industry’s 4% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are SL Green Realty (SLG – Free Report) and Vornado Realty Trust (VNO – Free Report) , each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for SL Green’s 2024 FFO per share has been raised 2.9% over the past month to $7.83.

The Zacks Consensus Estimate for Vorndo’s current-year FFO per share has moved a cent northward over the past two months to $2.16.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

Financial Market Newsflash

No financial news published today. Check back later.