Added to the Zacks Rank #1 (Strong Buy) list on Wednesday, Broadcom’s (AVGO – Free Report) stock is standing out as markets ripped higher on news that President Trump will temporarily rescind reciprocal tariffs on many countries outside of China.

Broadcom shares soared +18% in today’s trading session, as the S&P 500 and Nasdaq posted gains of +9% and +12% respectively. The leading chipmaker is benefitting from a pleasant trend of positive earnings estimate revisions, suggesting now may be an ideal time to buy the dip in AVGO which is still down 20% year to date amid broader market volatility.

Broadcom’s ASIC Dominance Continues

As the second largest AI chip supplier behind Nvidia (NVDA – Free Report) ), Broadcom’s expansion is being fueled by its specialization in application-specific integrated circuits (ASIC) which are designed to perform specific tasks rather than general-purpose computing. To that point, Broadcom is thought to control up to 60% of the market share for ASIC chips.

Furthermore, Broadcom’s concentration on AI processors is leading to significant revenue streams as hyper-scale clients such as Microsoft (MSFT – Free Report) ) and Alphabet (GOOGL – Free Report) build out their data centers for AI-specific applications and technology. What should lead to more optimism and higher investor sentiment is that Broadcom is also collaborating with Apple (AAPL – Free Report) as the iPhone maker is developing its first server processor for AI applications.

Tracking Broadcom’s Outlook

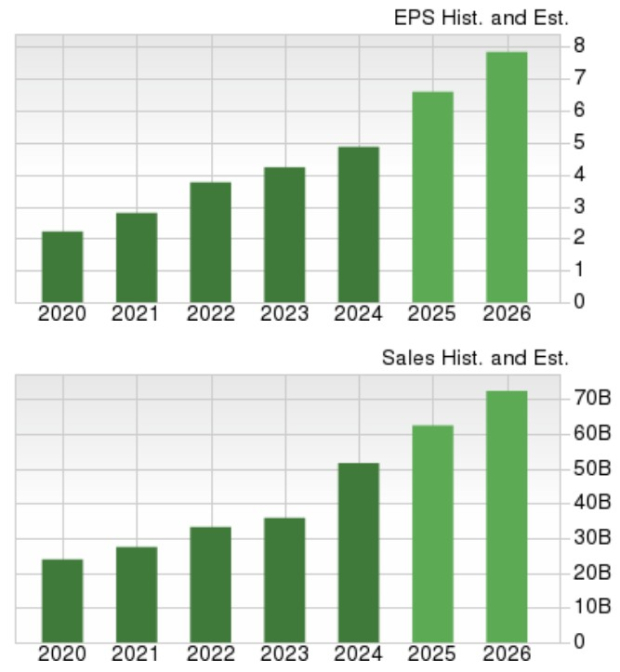

Based on Zacks estimates, Broadcom’s total sales are expected to increase by 21% in fiscal 2025 to $62.39 billion compared to $51.57 billion last year. More intriguing, FY26 sales are projected to spike another 16% to $72.3 billion.

On the bottom line, annual earnings are currently slated to soar 35% this year to $6.60 per share from EPS of $4.87 in 2024. Plus, FY26 EPS is forecasted to increase another 19% to $7.84.

Image Source: Zacks Investment Research

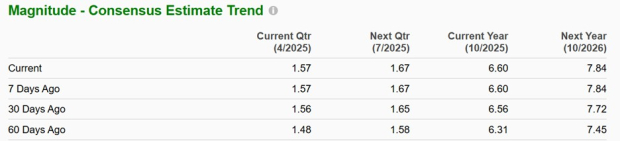

Suggesting the rally in AVGO could have legs is that FY25 and FY26 EPS estimates are nicely up in the last month and have now risen 4% and 5% over the last 60 days respectively.

Image Source: Zacks Investment Research

AVGO Historical Performance & Valuation

Despite the YTD drop in AVGO, Broadcom stock is sitting on +200% gains over the last three years and has skyrocketed over +1,300% in the last decade to impressively outperform the broader indexes and its Zacks Electronics-Semiconductors Market’s +311%.

Image Source: Zacks Investment Research

Making this year’s pullback more appealing is that AVGO is now trading at 23.6X forward earnings, which is near its industry average and the benchmark S&P 500’s 18.8X. It’s also noteworthy that AVGO is trading at a significant discount to its decade-long high of 47.9X forward earnings and closer to the median of 17.1X during this period.

Image Source: Zacks Investment Research

Bottom Line

With positive earnings estimate revisions suggesting the rally in Broadcom’s stock could continue, it may be advantageous to get in on the company’s stellar growth as the ASIC chip market is thought to be valued at upward of $20 billion and is rapidly expanding. Notably, the Average Zacks Price Target of $249.25 a share still suggests 34% upside for AVGO following today’s rally.

Financial Market Newsflash

No financial news published today. Check back later.