As we begin the new year investors will certainly be looking for stocks of companies that appear to be bargains.

Sitting near its 52-week lows at around $115 a share, Nucor (NUE – Free Report) stock may draw interest in this regard as one of the leading steel producers in the United States.

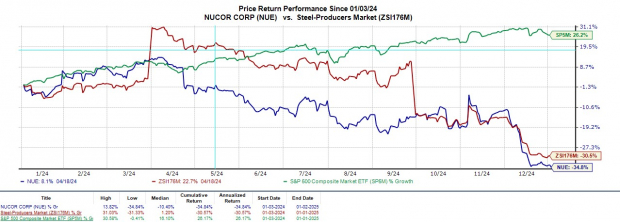

That said, let’s see if it’s time to buy Nucor stock for a rebound after falling more than 30% over the last year.

Image Source: Zacks Investment Research

Industry Challenges

As shown in the price performance chart above, Nucor hasn’t been alone in its struggles with the Zacks Steel-Producers Market also down 30% in the last year. Pricing pressures have been the main culprit with the price of Hot-Rolled Coil (HRC) steel near its one-year low at $706 per metric ton.

Additionally, higher raw material costs and supply chain issues have had an impact on Nucor’s probability.

Image Source: Trading Economics

Monitoring Nucor’s Outlook

Based on Zacks estimates, Nucor’s annual earnings are now expected to drop 53% in fiscal 2024 to $8.35 per share compared to EPS of $18.00 in 2023. Reassuringly, FY25 EPS is projected to stabilize and rebound 6% to $8.83.

However, Nucor’s total sales are slated to fall 13% in FY24 and are forecasted to dip another 2% in FY25 to $29.46 billion.

Image Source: Zacks Investment Research

NUE Valuation Comparison

Despite the contraction to Nucor’s top and bottom lines, NUE does stand out in terms of value at 13.9X forward earnings. This is above its Zacks Steel-Producers Industry average of 9.8X but beneath United States Steel’s (X – Free Report) 15.5X while offering a pleasant discount to the benchmark S&P 500. Furthermore, Nucor trades at less than 1X sales.

Image Source: Zacks Investment Research

Bottom Line

Nucor’s stock currently lands a Zacks Rank #3 (Hold). It may be too soon to say a sharp rebound is in store but Nucor’s attractive valuation should start to reshape investor sentiment. To that point, long-term investors may certainly be rewarded from current levels although better buying opportunities could still be ahead.

Financial Market Newsflash

No financial news published today. Check back later.