Signet Jewelers Limited (SIG – Free Report) stands out as a compelling value play within the industry. It is trading at a forward 12-month price-to-sales ratio of 0.32, down from the industry and the Retail-Wholesale sector’s average of 0.59 and 1.36, respectively. This undervaluation highlights its potential for investors seeking attractive entry points in the retail space. Moreover, SIG’s Value Score of A underscores its appeal as an investment option.

SIG Looks Attractive From a Valuation Standpoint

Image Source: Zacks Investment Research

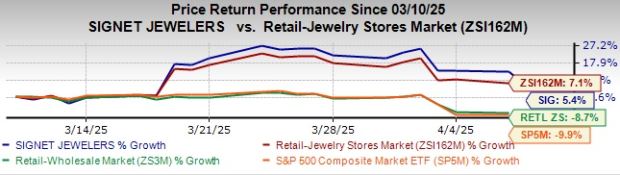

Shares of this company have gained 5.4% in the past month compared with the industry’s growth of 7.1%. The company surpassed the sector and the S&P 500’s decline of 8.7% and 9.9%, respectively.

Signet has reinforced its market leadership through strong strategic initiatives and a firm commitment to innovation. SIG is well-positioned for sustainable growth, driven by effective inventory management, real estate optimization and enhanced operational efficiency. As it continues to adapt to evolving consumer trends and focus on delivering shareholder value, the company is poised for long-term success in a dynamic retail environment.

SIG Stock Past-Month Performance

Image Source: Zacks Investment Research

Signet’s Momentum in Bridal and Fashion Jewelry Segments

Signet marked notable gains in its bridal and fashion jewelry segments during the fourth quarter of fiscal 2025. Bridal jewelry, accounting for nearly half of the company’s merchandise sales, posted a 2% increase in average unit retail (“AUR”), its strongest in the past two years. This improvement highlights the success of strategic pricing and innovative product offerings that continue to resonate with affluent consumers.

Fashion jewelry also delivered strong results, with AUR climbing 8%. The key contributor was a 60% year-over-year spike in lab-grown diamond sales as of March 19. This growth not only elevated the premium mix of offerings but also expanded market share by five percentage points. By appealing to both established tastes and newer preferences, Signet is effectively strengthening customer engagement and sustaining AUR momentum across core categories.

SIG’s Streamlined Structure Boosts Efficiency and Cuts Costs

In pursuit of enhanced operational performance, Signet initiated a company-wide restructuring in the fiscal fourth quarter. Shifting from a traditional banner-focused model to a more brand-led strategy, the company streamlined leadership by 30% and centralized essential functions like merchandising, media planning and repair services.

This structural realignment enabled tighter cost controls, particularly around store labor, contributing to a 4.9% year-over-year decrease in SG&A expenses, which totaled $639.2 million in the fiscal fourth quarter. Although a slight percentage increase due to strategic investments in advertising, management anticipates $50-$60 million in annualized savings from these efforts.

Over the longer term, Signet is targeting at least $100 million in SG&A improvements. These measures are intended to accelerate decision-making, improve operational accountability and drive long-term margin expansion.

SIG’s Encouraging FY26 Outlook

Signet’s outlook for fiscal 2026 reflects management’s confidence in its operational execution and growth strategy. For the fiscal first quarter, the company projects total sales in the range of $1.5 billion to $1.53 billion, with same-store sales expected to remain flat or increase up to 2%. This marks a meaningful improvement from the same period in fiscal 2025, when total sales were $1.5 billion and same-store sales declined 8.9% year over year.

Adjusted operating income is expected to fall between $48 million and $60 million, while adjusted EBITDA is projected to be $94 million to $106 million compared with $57.8 million and $101.5 million, respectively, in the previous year’s first quarter.

For the full fiscal year, total revenues are forecasted between $6.53 billion and $6.8 billion, with same-store sales ranging from a 2.5% decline to a potential 1.5% increase. This comes on the heels of fiscal 2025 results, which included $6.7 billion in revenues and a 3.4% decrease in same-store sales.

The company anticipates adjusted operating income between $420 million and $510 million, largely supported by savings from its restructuring initiatives. Adjusted EBITDA is expected to range from $605 million to $695 million and adjusted earnings per share are projected between $7.31 and $9.10 compared with $666.1 million and $8.94, respectively, in fiscal 2025.

Signet’s Regional Slowdown Poses Growth Challenges

Despite positive signals in guidance, Signet continues to face softness in both its North America and international markets. In the fiscal fourth quarter, North America’s revenues declined 5.6% year over year to $2.22 billion, with same-store sales falling 1.1%.

International performance saw a steeper drop, with sales down 10.9% to $126.2 million and same-store sales declining 1.5%. On a constant-currency basis, international sales fell 11%. These declines signal ongoing challenges in maintaining consistent growth across geographies, highlighting potential risks that could impact overall revenue performance in the coming quarters.

Final Words on SIG

Investors may find SIG stock attractive due to its strong fundamentals, efficient cost-cutting through strategic restructuring and solid growth in bridal and fashion jewelry segments. The company’s brand-led transformation and focus on operational excellence are boosting margins and positioning it for sustainable success. Its growing presence in lab-grown diamonds also reflects adaptability to evolving consumer trends. While Signet continues to face headwinds in certain regional markets, its proactive management and innovation-driven approach offer encouraging signs for long-term value creation. The company currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked stocks in the retail space are The Gap, Inc. (GAP – Free Report) , Stitch Fix (SFIX – Free Report) and Deckers Outdoor Corporation (DECK – Free Report) .

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s fiscal 2025 earnings and revenues indicates growth of 7.7% and 1.6%, respectively, from fiscal 2024 reported levels. GAP delivered a trailing four-quarter average earnings surprise of 77.5%.

Stitch Fix delivers customized shipments of apparel, shoes and accessories for women, men and kids. It currently has a Zacks Rank of 2 (Buy).

The Zacks Consensus Estimate for Stitch Fix’s fiscal 2025 earnings implies growth of 64.7% from the year-ago actuals. SFIX delivered a trailing four-quarter average earnings surprise of 48.9%.

Deckers is a leading designer, producer and brand manager of innovative, niche footwear and accessories. It carries a Zacks Rank #2 at present.

The Zacks Consensus Estimate for Deckers’ fiscal 2025 earnings and revenues implies growth of 21% and 15.6%, respectively, from the year-ago actuals. DECK delivered a trailing four-quarter average earnings surprise of 36.8%.

Financial Market Newsflash

No financial news published today. Check back later.