Zebra Technologies Corporation (ZBRA – Free Report) recently announced its plan to acquire Photoneo, a market leader in the 3D machine vision solutions industry. The financial terms of the proposed buyout have been kept under wraps.

ZBRA’s shares lost 1.3% yesterday to eventually close the trading session at $383.85.

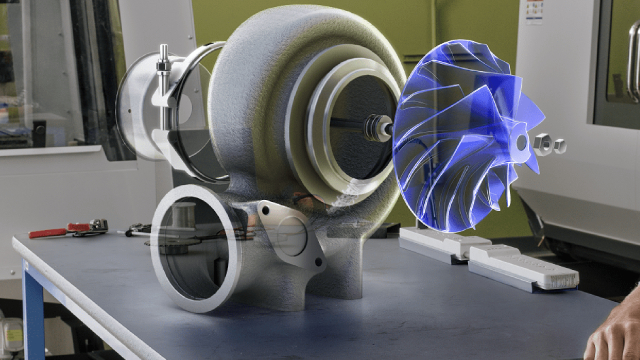

Based in Slovakia, Photoneo is engaged in developing robotic vision and intelligence solutions. The company is well-known for manufacturing advanced 3D cameras with the world’s highest resolution and accuracy features. Photoneo’s intelligent robots enable companies from the food, automotive, logistics and e-commerce industries to boost their efficiency of manufacturing, fulfillment and assembly processes.

Acquisition Rationale

The latest buyout is in sync with Zebra’s policy of acquiring businesses to strengthen its business and product portfolio. The buyout will enable the company to combine Photoneo’s 3D machine vision solutions with its advanced sensors, vendor-agnostic software and AI-based image processing capabilities. This will enable ZBRA to enhance its portfolio of 3D machine vision solutions and address customers’ several challenges in high-value applications. This includes bin picking, depalletizing and inspecting objects utilized in logistics, automotive manufacturing and other industries.

Management expects the transaction to be completed in the first quarter of 2025, conditioned on the fulfillment of certain customary closing conditions.

Zacks Rank & Price Performance

Zebra is focusing on advancing digital capabilities, optimizing the supply chain and expanding data analytics capabilities to engage with its customers. Higher sales of mobile computing and data capture solutions are supporting the Enterprise Visibility & Mobility segment’s sales. Higher sales for printing solutions and RFID products are also boosting the Asset Intelligence & Tracking segment.

Image Source: Zacks Investment Research

In the past year, the Zacks Rank #2 (Buy) company’s shares have gained 40.4%, in line with the industry’s 40% growth.

The Zacks Consensus Estimate for 2024 earnings has increased 10.6% to $14.04 per share in the past 60 days.

Other Stocks to Consider

Some other top-ranked stocks from the Zacks Industrial Products sector are discussed below.

Graham Corporation (GHM – Free Report) currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GHM delivered a trailing four-quarter average earnings surprise of 101.9%. In the past 60 days, the Zacks Consensus Estimate for Graham’s fiscal 2025 earnings has increased 8.4%.

Federal Signal Corporation (FSS – Free Report) presently carries a Zacks Rank of 2. FSS delivered a trailing four-quarter average earnings surprise of 11.8%.

In the past 60 days, the Zacks Consensus Estimate for Federal Signal’s 2024 earnings has increased 3.1%.

Generac Holdings (GNRC – Free Report) presently carries a Zacks Rank of 2. The company delivered a trailing four-quarter average earnings surprise of 10.8%.

In the past 60 days, the consensus estimate for GNRC’s 2024 earnings has increased 5.4%.

Financial Market Newsflash

No financial news published today. Check back later.